Austria

Retail locations 2024: Significant decline and only very small rays of hope

The changing retail landscape is also reflected in the expansion plans of chain retailers, restaurateurs, and retail-related service providers, as the current analysis by RegioData Research of over 750 active distribution channels shows.

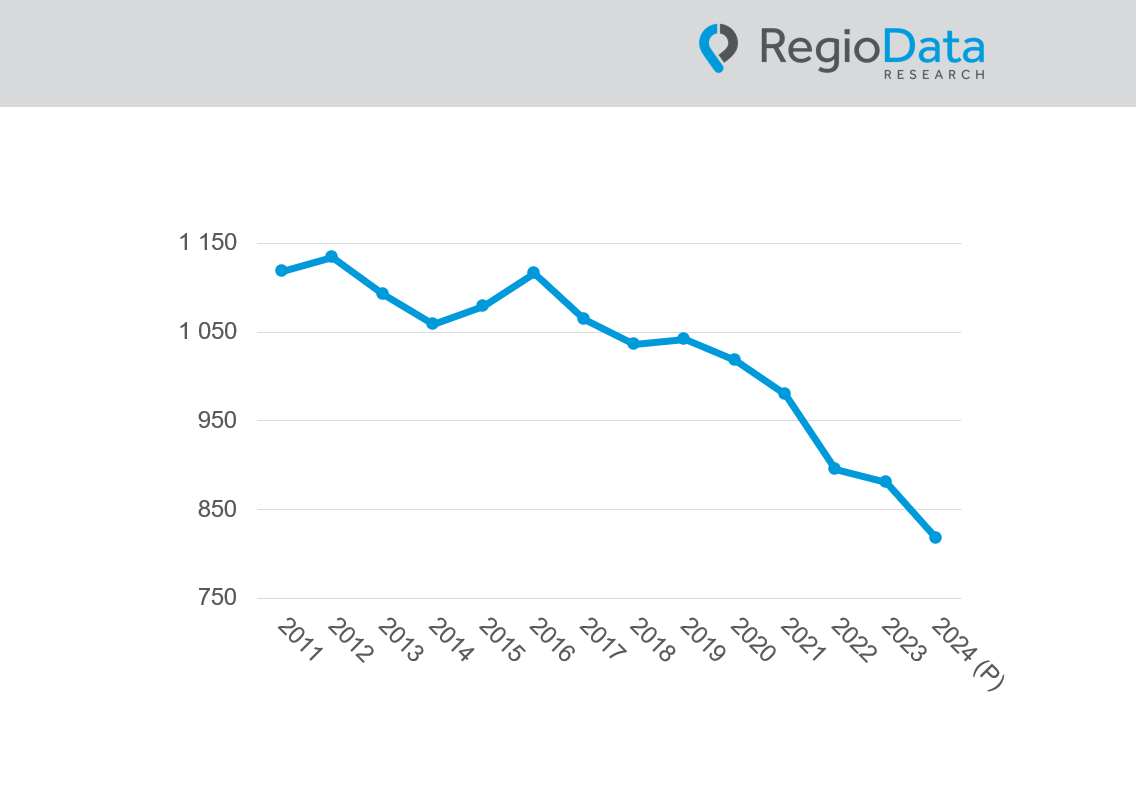

Sales area and number of locations falling faster than before

For 10 years, the total sales area in Austria has been continuously falling by 1.0% to 1.5% per year. In 2023, it decreased by more than 2.0% for the first time. Consequently, the number of stores is also decreasing faster – in 2023, more than 1,200 locations of retail chain stores and independent merchants in the retail sector closed. These closures no longer only affect independent merchants as they used to, but also affect retail chains, which are increasingly thinning out their network of locations.

Shoe retailers have been hit particularly hard in recent years, losing over 100 additional locations since last year alone. Thus, 2023 marked another significant downturn for the shoe retail sector in Austria, following CCC’s closure and the announcements of Salamander and Delka withdrawing from the market, as well as Reno’s insolvency. Now, MyShoes at Deichmann is following suit, leading to the closure of a total of 27 locations by the end of the year 2024. There is also a decline in the shoe alliance ANWR-Garant with 9 fewer locations compared to the previous year.

A similar process of shrinkage is also observed in the clothing retail sector. The number of locations decreased by more than 300 last year, although some more discount-oriented textile retail chains had simultaneously expanded strongly. Affected closures were primarily distribution channels in the mid-price segment.

Gastronomy and food retail focus on expansion

Among the 24 sectors examined from retail, catering and retail-related services (e.g. hairdressers, banks), only the gastronomy sector is showing signs of expansion. Compared to the previous year, the sector recorded an increase of around 1.5 %, with system catering increasing the number of locations by 19 %. Many new openings, which specifically appeal to the younger target group, have contributed to this growth. The current widely lamented ‘death of the pub’ does not refer to the entire catering industry; on the contrary, there is hardly any other sector in which sales and locations are increasing as strongly as in the catering industry.

The food retail sector has now also picked up slightly (+11% growth in locations), after the pace of expansion had slowed considerably in the previous year. In contrast, the previously rapidly expanding fitness centres and bakeries have become very quiet.

Location search remains very cautious and selective

Based on the information provided by the individual retail chains, the number of new locations currently being sought can be estimated at around 600-650, although almost twice as many existing retail and catering locations were closed this year. What has changed significantly, however, is both the size and the location of the sought-after properties.

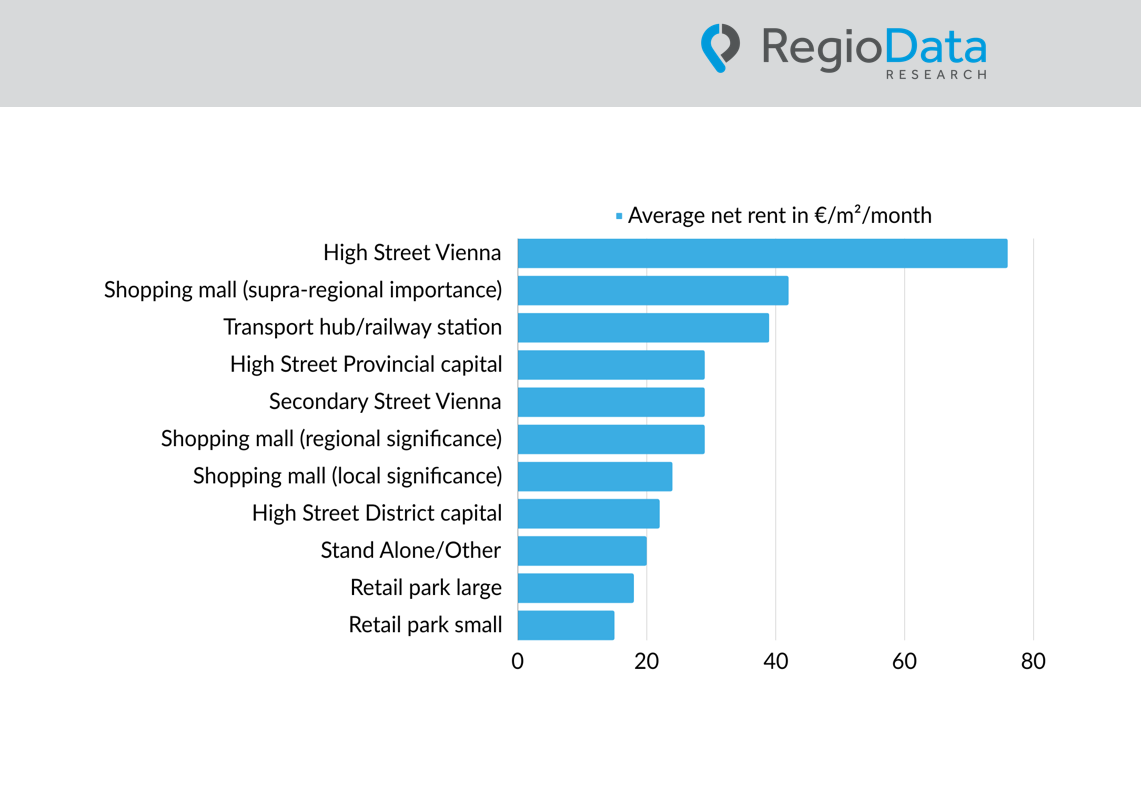

In the current market development, there is a strong preference from about half of the expanding distribution channels (49%) for retail spaces between 100 and 200 square meters, especially among clothing retailers and restaurateurs. These are significantly smaller areas than about 5 years ago. It is also evident that particularly large locations are steadily losing significance: demand for retail spaces over 5,000 square meters has practically halved in the last five years. Despite the rise in net rents in Austrian high streets, a significant majority of 86% of distribution channels are interested in inner-city locations. Shopping malls and retail parks are no longer the first choice.

New entries into the Austrian market

Each year, approximately 30-35 internationally operating retail and gastronomy chains open their first location in Austria. While in gastronomy, it is mostly about simple and fast food, in retail, it is either luxury brands or discounters. Companies offering luxury goods usually settle for one or two locations in prime areas, whereas discounters often aim for nationwide coverage (e.g., Action, Thomas Philipps, Zeeman, Woolworth).

Lasting change in the retail sector

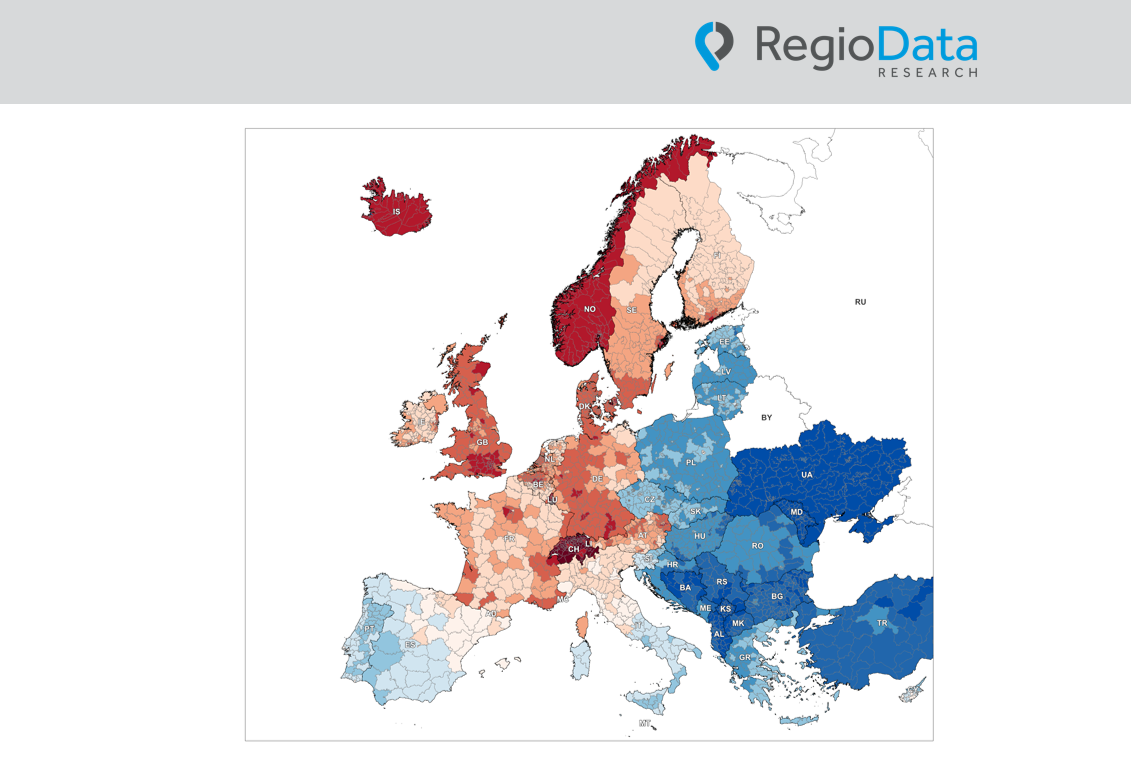

While the gastronomy sector continues its growth trajectory, the retail landscape has been undergoing profound changes for some time now. As a result, the expansion behavior of retailers is showing significant restraint. The cause can be attributed to a variety of factors, including the impact of the COVID-19 pandemic, changing consumer preferences, and the increasing dominance of online commerce.

The long-term trends are clear: online commerce will continue to gain market share, especially as younger demographics increasingly prefer the convenience of online shopping. Consequently, stationary retail spaces are expected to continue shrinking annually by approximately 1.5 to 2.5%. This will lead to the gradual loss of the retail sector’s dominant role in city centers and an overall reduction in commercial zones.

share post