austria

Shoe retail under pressure: Between giants and strugglers

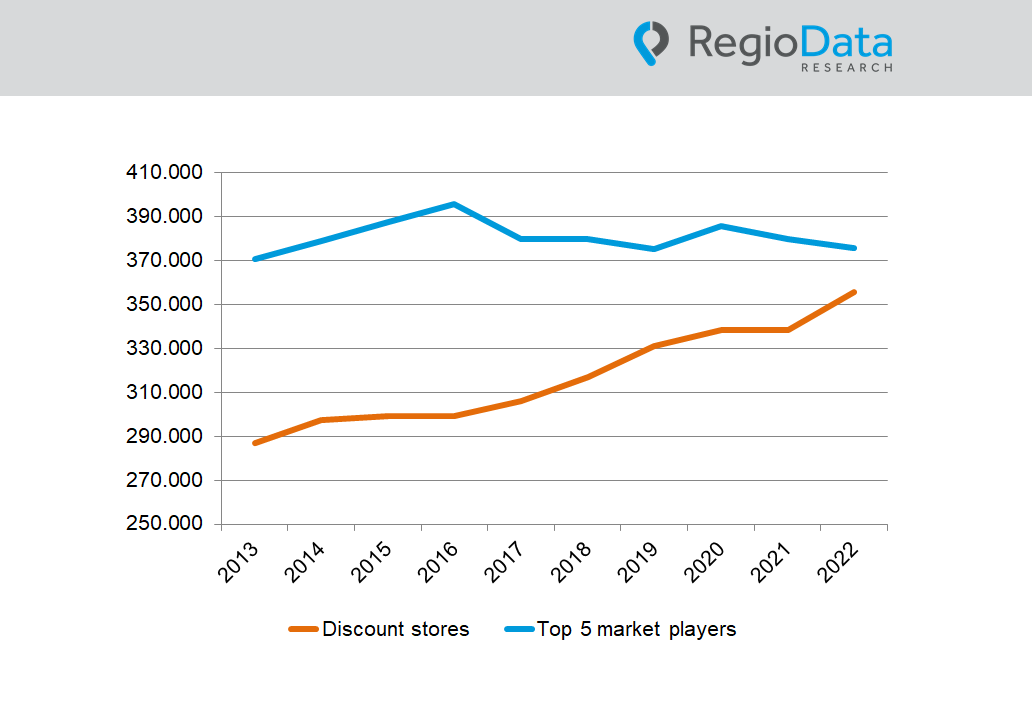

The Austrian shoe retail sector has undergone a dramatic transformation in recent years, as the latest analysis of RegioData location data now reveals: Since 2014, the number of locations has decreased by a remarkable 23%, which is attributed to profound changes in consumer habits.

A primary reason for this decline is the persistent trend of buying shoes online and utilizing alternative distribution channels beyond traditional shoe stores—primarily platforms like Zalando. The convenience of online shopping and the wide selection have increasingly prompted consumers to shift their shoe purchases to the internet. Additionally, both the sports goods retail, especially in the sneakers segment, and the clothing retail are increasingly capturing significant market shares

Furthermore, the provider structure has also undergone massive changes in recent years. For decades, particularly Leder & Schuh AG and the Stiefelkönig/Delka Group dominated the market. From 2014 onwards, new players such as CCC, Geox, and Ecco finally brought about a temporary upturn. In 2016, the industry giants were suddenly forced to close a multitude of their locations, with Vögele Shoes going bankrupt in Austria just one year later, with 49 stores. This should also mark the beginning of a downward spiral in shoe retail.

The Corona pandemic has further accelerated this trend, reflected since 2020 in the closure of approximately 200 locations nationwide in Austria. Particularly noteworthy was the withdrawal of the shoe giant CCC from Austria, which contributed significantly to the overall decline with nearly 50 locations.

While many shoe retailers continue to struggle with these aftermaths, Deichmann has become the benchmark. In contrast to its competitors, Deichmann has recorded steady, albeit moderate expansion over the years. In Austria alone, the industry giant operates 231 locations, including MyShoes and Snipes, out of a total of over 800 shoe shops.

Austrians allocate approximately 17% of their shoe expenditures (including all distribution channels, both in-store and online) to Deichmann, while Leder & Schuh AG captures around 11%, and Zalando already secures 6%.

The latest developments highlight another significant upheaval in the industry: with the closure of 40 locations by Salamander and Delka, along with the insolvency of Reno, which had nearly 30 locations in Austria in 2023, the transformation in shoe retail is once again emphasized. Additionally, MyShoes will be discontinued as a distribution line at Deichmann, affecting another 28 locations by the end of 2024. The future will reveal if and how the remaining retailers adapt and find new ways to survive in this evolving market.

share post