austria

Retail rents are rising significantly lower than inflation

RegioData Research annually examines approximately 1,500 existing lease agreements from companies in the retail and retail-related sectors. This unique, objective, and independent survey provides a detailed insight into the current status and development of rent levels for commercial areas, industries, and floor sizes.

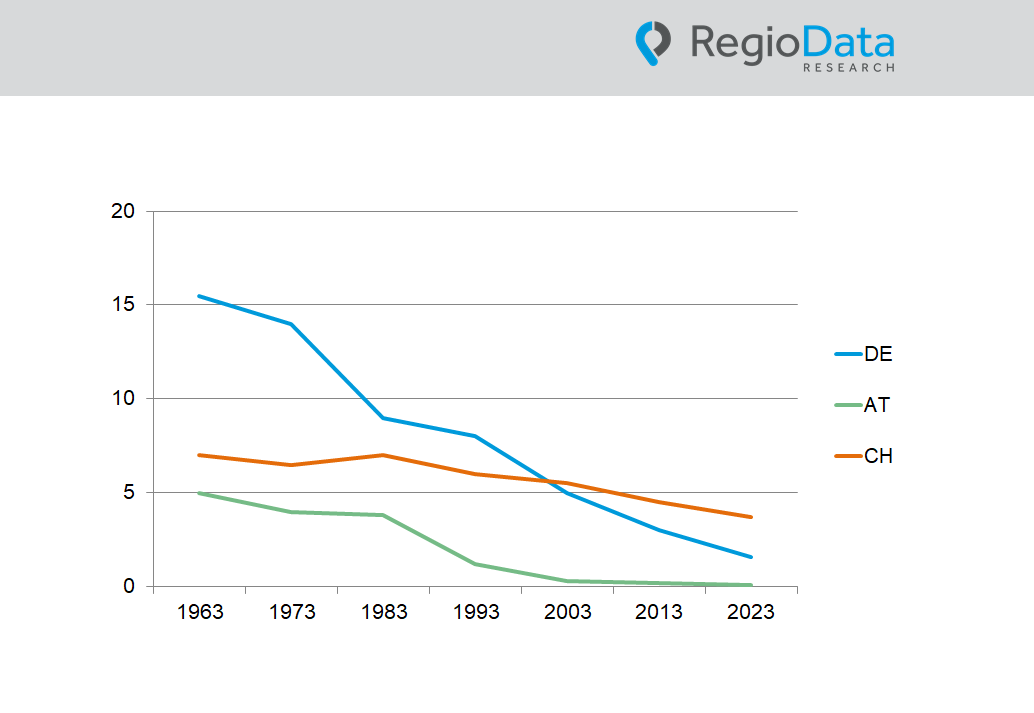

This year’s analysis reveals that while the rent level of the analyzed contracts has increased since 2019, it has not increased to the same extent as inflation. Although indexation was agreed upon in most cases, new leases on average achieved rents approximately 10-12% lower, and in some cases, reductions were granted for existing contracts. Approximately 20% of all retail and gastronomy tenants negotiated rent reductions with their landlords during the COVID-19 pandemic. In many cases, not only a temporary but also a permanent reduction was achieved, often with a longer waiver of termination as compensation.

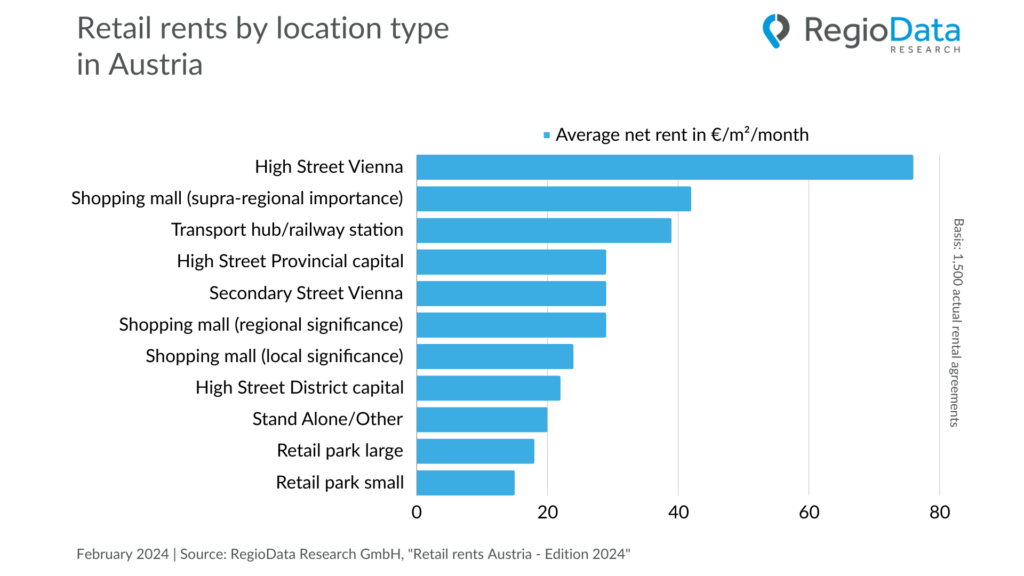

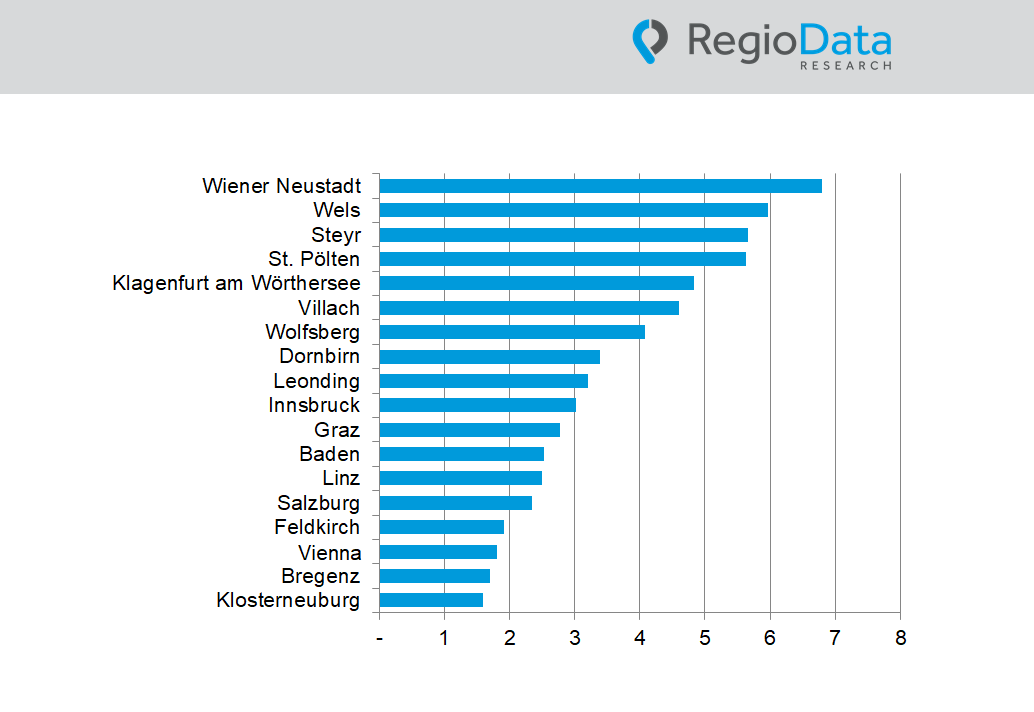

The analysis of retail rents in Austria 2024 (based on 1,500 existing lease agreements) shows that clothing retailers in Vienna’s city center pay the highest rents, up to €350/m² (net, excluding additional costs) for areas between 100 and 300 m². Bakeries at major train stations follow with nearly €200/m². The lowest rent levels, averaging €15/m², are found in district capitals and small retail parks. For the same size and location, clothing retailers and sports goods retailers pay the highest rents, while electronics retailers pay the lowest.

Particularly significant are the rent variations in shopping malls with regional significance. The analyzed contracts exhibit an impressive range from €0/m² to €181/m². Although the number of companies paying no net rent has slightly increased, the share of these companies is less than 0.5%. These companies are either insolvent or play such a crucial role in attracting foot traffic for the center operator that eviction is waived.

In conclusion, there is a slight decrease in the proportion of newly concluded lease agreements with turnover-dependent rents. The electrical/electronics retail sector (including telecommunications) pays the highest turnover-dependent rents, up to 17%, while hardware stores and pharmacies generally do not enter into such agreements.

The data clearly show that rental prices are strongly influenced by factors such as location type, industry, and company size. Furthermore, a gradual shift in the market is evident: previously, landlords could select tenants from a variety of interested parties in prime shopping malls and inner-city locations. Now, the focus is on avoiding vacancies even in very good locations. This trend not only reflects a shift in consumer behavior but also signals a reorientation of the retail landscape.

share post