austria

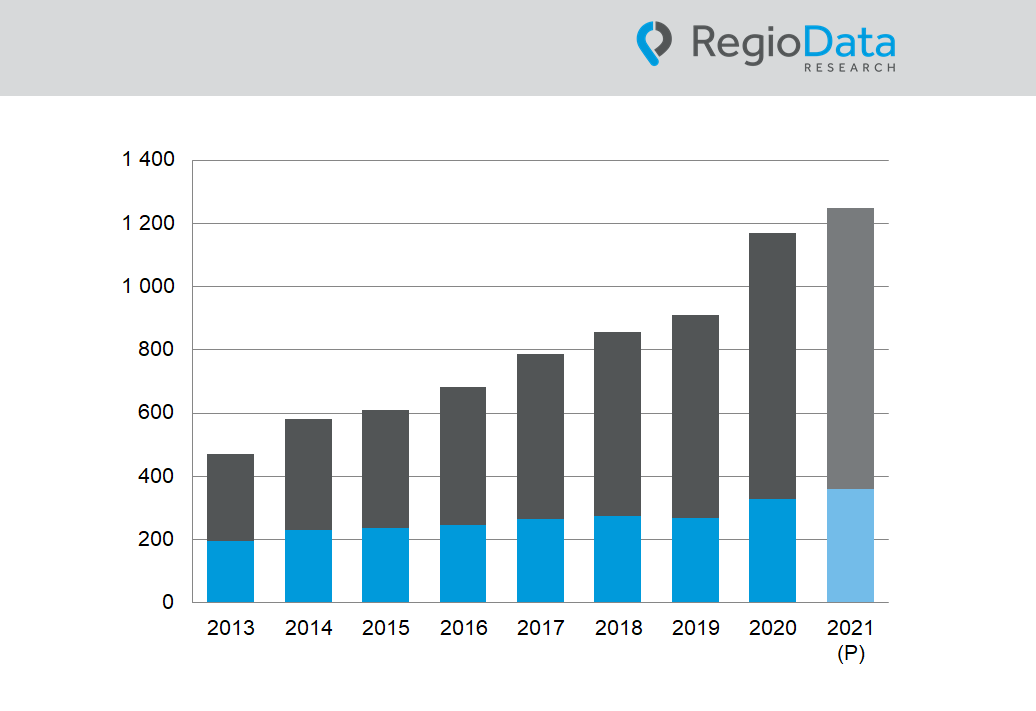

Online revenues increased to 12 billion

RegioData Research presents the preliminary results of online retailing for 2021: Every Austrian makes an average annual purchase of €1,350 on the Internet – 14% more than a year ago. However, online shopping behaviour is currently subject to a rapidly changing process that has even caused industry leader Amazon to lose market share.

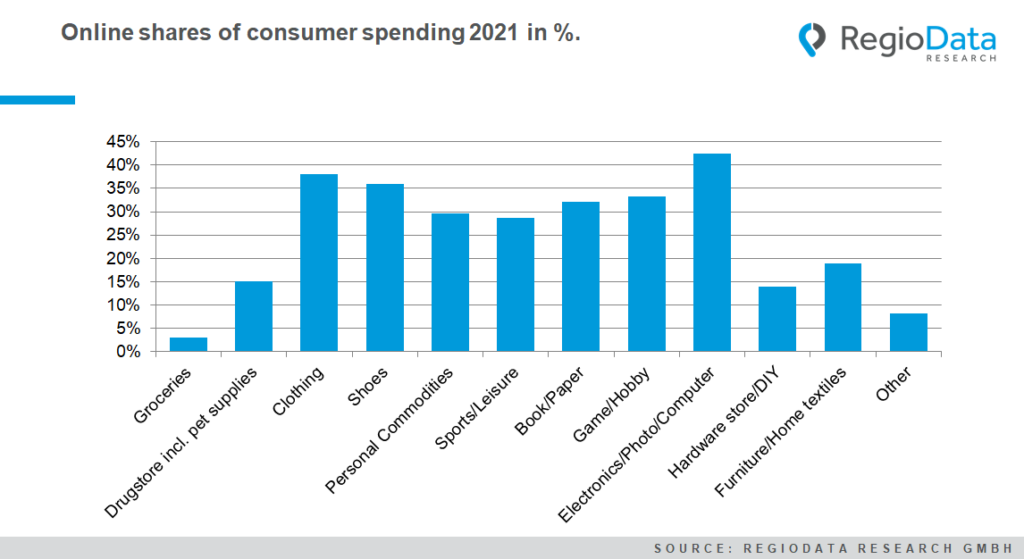

Clothing and electronics are the online bestsellers

A full €260 is spent online on clothing and €250 on electrical and electronic equipment. Accordingly, 30 to 40 percent of these medium-term consumer goods are already purchased online.

There has also been a sharp rise in spending on long and short-term necessities. Online spending on furniture, for example, amounts to around €120, followed by grocery spending at an average of €80, with the latter increase mainly attributable to the pandemic, including curfew restrictions, food outlets and home offices.

However, a key question for the future development of the overall online share remains the extent to which the food retail sector, which is strong overall in terms of sales and has its roots predominantly in stationary stores, will succeed in managing online stores profitably and in the long run.

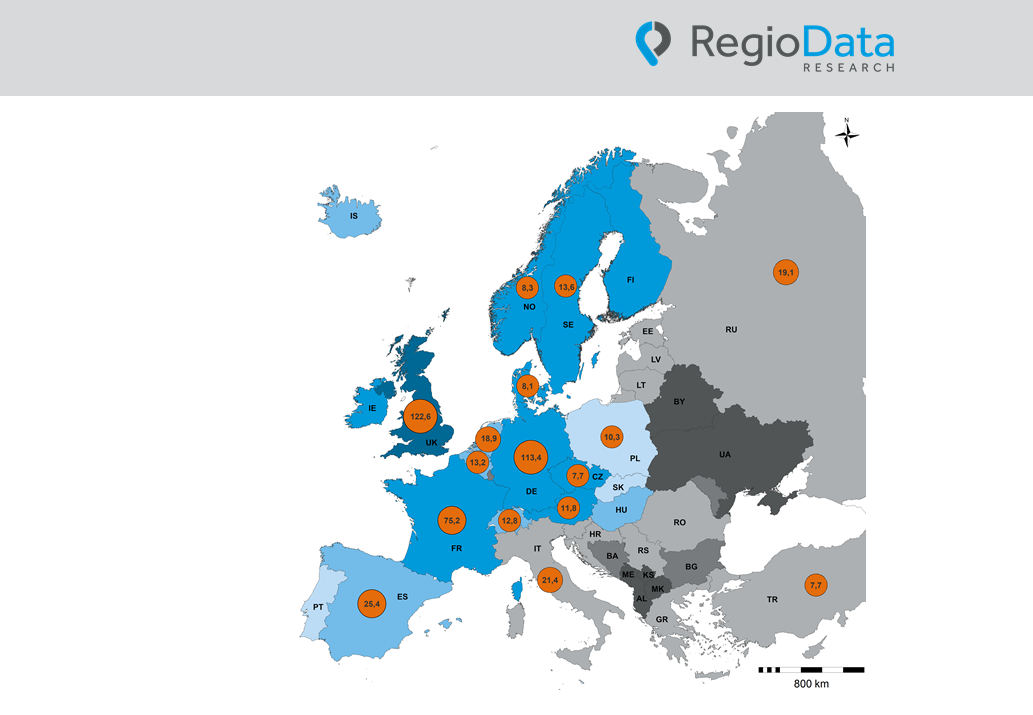

Austria at the forefront of Europe

Compared internationally, Austria is in the middle of the field with a current online share of around 17% of all private household spending. In Europe, only the United Kingdom is significantly higher at 27%, while Germany and Denmark are slightly higher than Austria.

A look at the Asian region shows where the journey may lead: China secures the top international position in online purchasing power with an impressive 40%, while South Korea takes second place with a whopping 35%. By comparison, the online share in Europe varies between 4% and 18%.

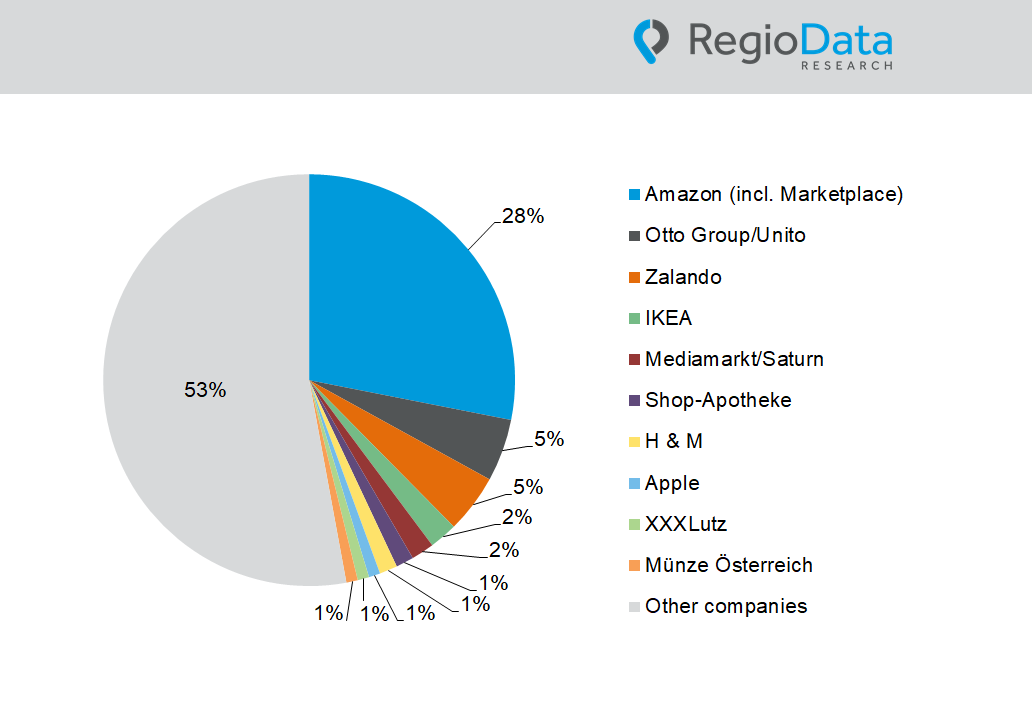

Concentration process on the Internet halted

The last few years have been characterized by increasing market shares of the “Big Three” – Amazon, Otto and Zalando. Overall, these companies have been consistently achieving larger market shares. Most recently, Austrians spent 34% of all online spending with one of these three companies (including Amazon Marketplace). Currently, sales are still rising, but not quite as fast as the market itself: On the one hand, many specialized providers and virtual marketplaces are emerging; on the other hand, Austrians are now relying somewhat more on local providers online. All in all, this has set in motion a striking development, namely a stagnation of the previously growing market shares on the part of the online giants.

“Store decline” on the Internet

The number of online stores relevant to Austrians is growing steadily and currently stands at just under 9,000. However, only a small proportion of these are able to generate sales that cover the costs of operation, marketing and the logistics behind them. It is estimated that only 350 stores can actually break the 1 million euro mark in terms of sales. As a result, many stores are no longer actively maintained after a short time – most of them are already devoured by the marketplace giants or slowly languish.

Virtual marketplaces – the measure of all things

Amazon is leading the way: Its virtual marketplace skims off around 12% of all online sales by Austrians.

In principle, everything revolves around visibility on the Internet, which ultimately only a major player can ensure. Freshly launched online marketplaces from Zalando, Douglas or MediaMarktSaturn and Co. show that the “remaining” retail giants have by no means slept through this trend. In addition to many external partners, such projects naturally require a lot of capital, which needs to be raised in order to remain relevant.

The virtual “upgrade” is also noticeable locally. In addition to Shöpping, which has around for some time and advertises Austrian retailers, AgoraOnline, a marketplace for regional small businesses, has also gone online. Austrian agriculture has now also arrived in the virtual marketplace Olympus with Markta, an online farmers’ market for regional organic products.

New dynamics through new technology

The wave of success of online retailing is undoubtedly unstoppable. Intelligent furniture planning, live shopping, virtual intelligence (VI), etc. will soon change the picture permanently. It will also expand to include the so-called voice shopping, which essentially aims to reach and support potential customers during online shopping with the help of voice search. Digital and physical shopping experiences will increasingly merge with each other, and thus accentuate a mutual fertilization as part of a “phygital” shopping experience. In any case, there should be no shortage of ideas for a future-oriented and innovative online experience.

share post