Austria

Where do our online sales go?

A recent study by RegioData Research, which analysed online stores for the first time, shows how Austrians “do it” on the Internet. The result is sobering: Only 27% of sales remain in Austria.

16 % of Austrian consumers’ spending is online

For the annual update of the study, RegioData Research examined more than a thousand online stores that are specifically relevant for domestic consumers. The results underpin the fact that Austrians are developing an ever-growing preference for convenient shopping and are leaving more money there every year. The Covid 19 crisis is accelerating this development.

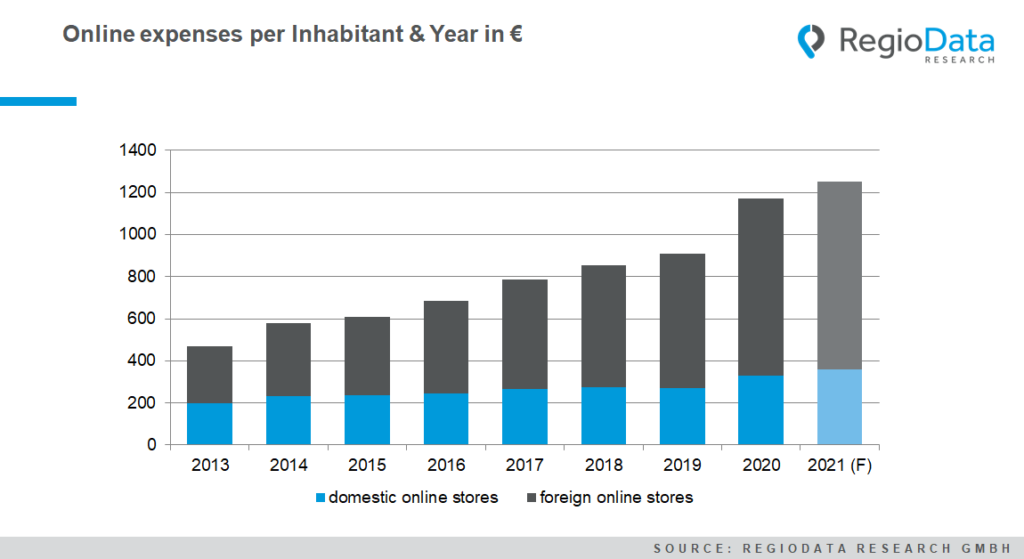

Currently, around 16% of all retail-related spending by domestic consumers is made via the Internet, amounting to around EUR 11 billion per year. Every Austrian spends an average of approximately EUR 1,250 per year online – twice as much as just five years ago.

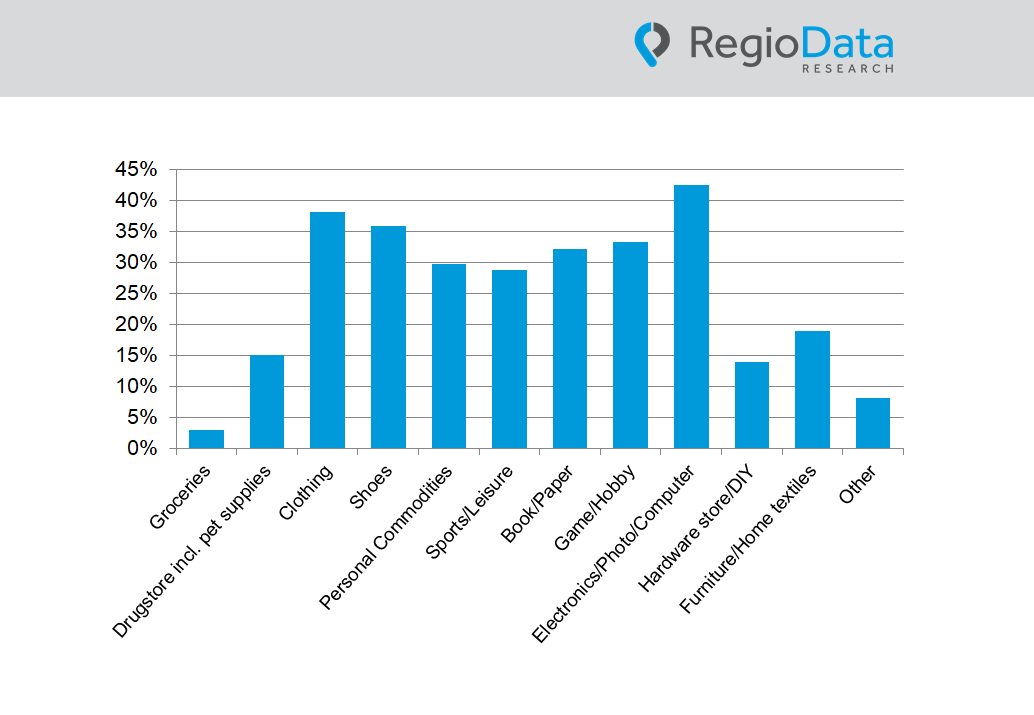

There are significant differences in the sectors of online retailing in Austria: While more than one-third of clothing is already purchased online, only slightly more than 2% of food purchases are online – although the trend is on the rise.

Only 27 % of online retail sales remain in Austria

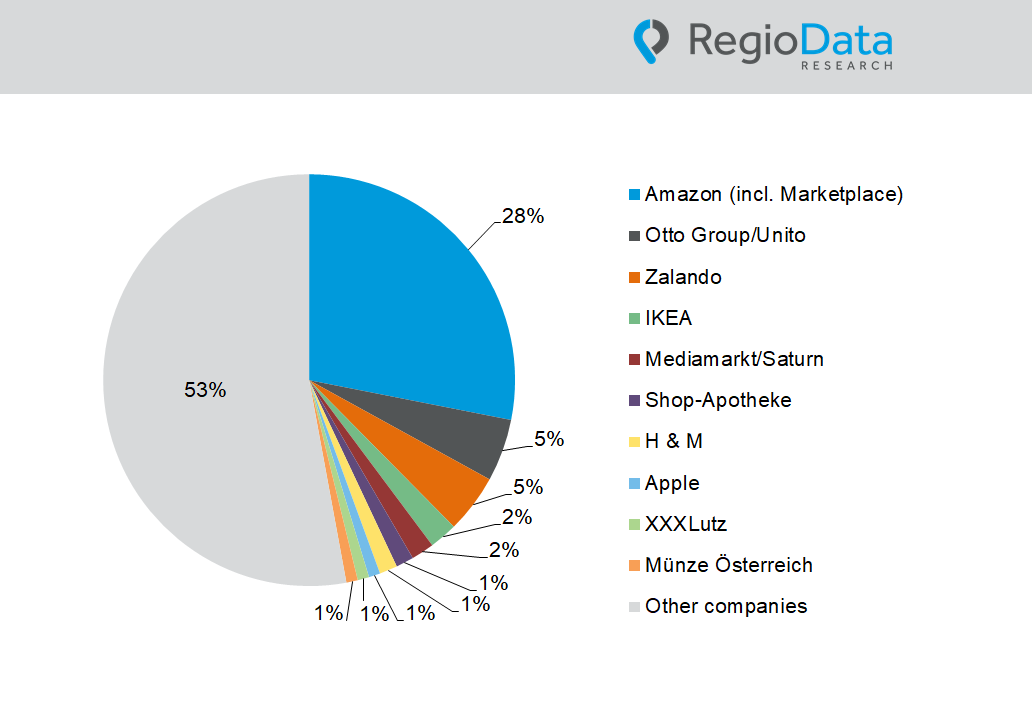

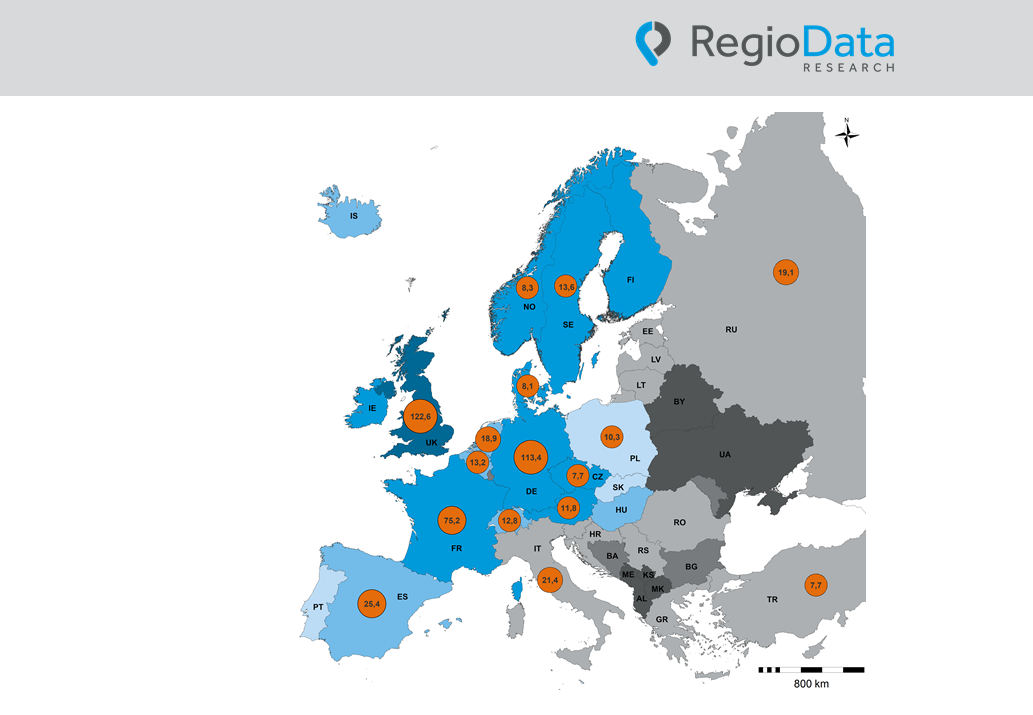

For the domestic economy, the decisive factor is where online retail sales amounting to around EUR 11 billion per year flow. De facto, only about 27% of these remain with companies having a registered office in Austria. The dominant 71% of the pie takes up by companies based abroad. The most diverse German online stores stand out with around 34%, and the US giant Amazon with approximately 30%.

The growing share of foreign sales is remarkable. According to RegioData Research, online retail sales remaining in Austria amounted to 36% three years ago. German online stores, in particular, whose market share was only around 25% at the time, have made significant gains.

“Buy local”-appeals fall flat

The situation is further complicated over the fact that most of the powerful domestic online stores are branches of international corporations. This applies, for example, to MediaMarkt, Ikea, and H&M. Exceptions include e-tec, Spar, the Austrian Mint, and XXXLutz. Anyone who purchases from their stores on the Internet is – knowingly or not – actually buying Austrian.

Appeals to consumers to consciously purchase Austrian or regional products online only resonate with a few target groups, which is not surprising. For example, a television set purchased via “Shöpping” or “Kaufhaus Österreich” usually comes from China just as much as from Amazon.

Only the grocery retail can secure a unique position here. As mentioned, only 2% of domestic online retail sales flow into baked goods, fruit, vegetables, meat, dairy products & Co. Austrians invest their average of 75 euros per person and year in stores with a clear regional focus, such as Billa, Interspar, Wein & Co, M-Preis, etc. Amazon plays a minor role in the grocery trade with a market share of 2%.

Progressive concentration

In general, digital environment and consumer habits of Austrians are changing visibly. New marketplaces are taking shape, or existing ones are expanding, and innovative offerings such as live online shopping are being created and are already relevant sales channels in Asia, for example. All of this entails massive investments. Logistics and marketing are no less cost-intensive.

In any case, the mass of online stores is burgeoning. But only few are running well and making a profit. Too many are not up to date or are perishing in the net. As a result, the concentration process in online retailing will continue – as is the case in stationary retailing. For the next few years, we can thus expect to see a “death of the store” on the Internet as well.

Share post