Austria

The disillusionment in online retailing

RegioData Research presents the results of its analysis of the 1,000 most important online stores for Austrians: Disillusionment after the Corona kick, strong concentration tendencies and specialized shooting stars.

Increases are quite decent at the moment

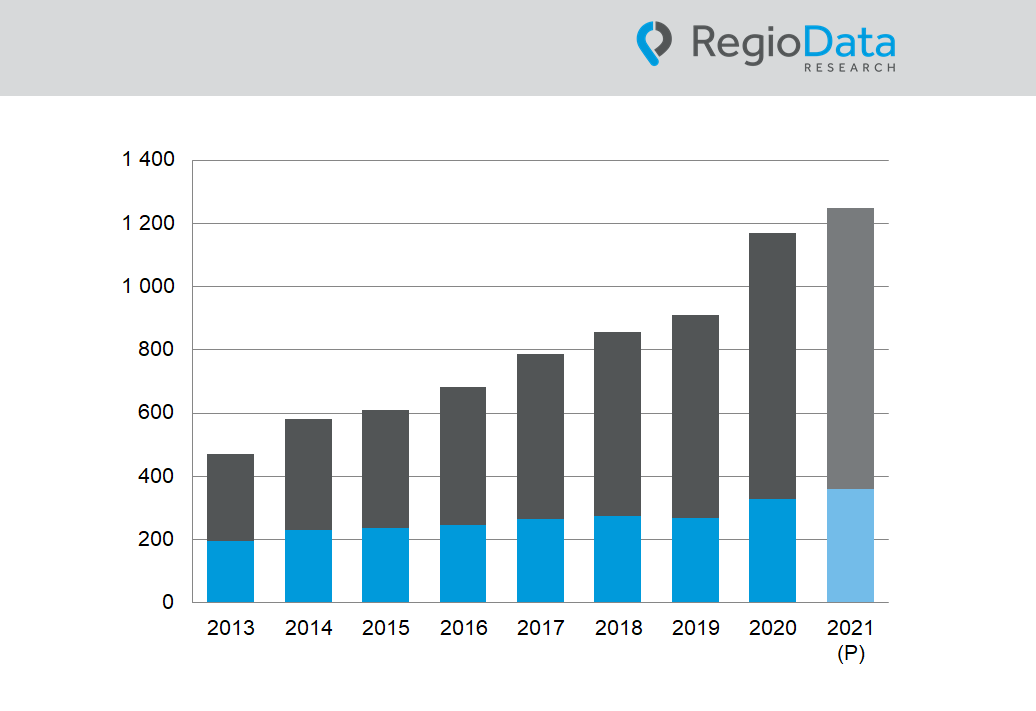

After online commerce in Austria made a truly astronomical leap upwards from 2019 to 2020 – due to corona – by almost + 20%, the increase from 2020 to 2021 was significantly lower by only 4%. Austrian households currently spend € 11.3 billion per year on the Internet. An increase of only 4.3% is expected for the year 2022. However, the expected higher inflation will ultimately lead to a significant decline – for the first time since the opening of the first online store.

But the victory march is unstoppable

In 2021, online spending per capita in Austria amounted to €1,265.3, or 16.2% of all retail-related consumer spending. Corona has attracted new customer groups, and young people are much more online-savvy now, meaning increases can be expected in the medium and long term. Depending on the scenario, the online share in Austria will already be between 20% and 22% within the next three years.

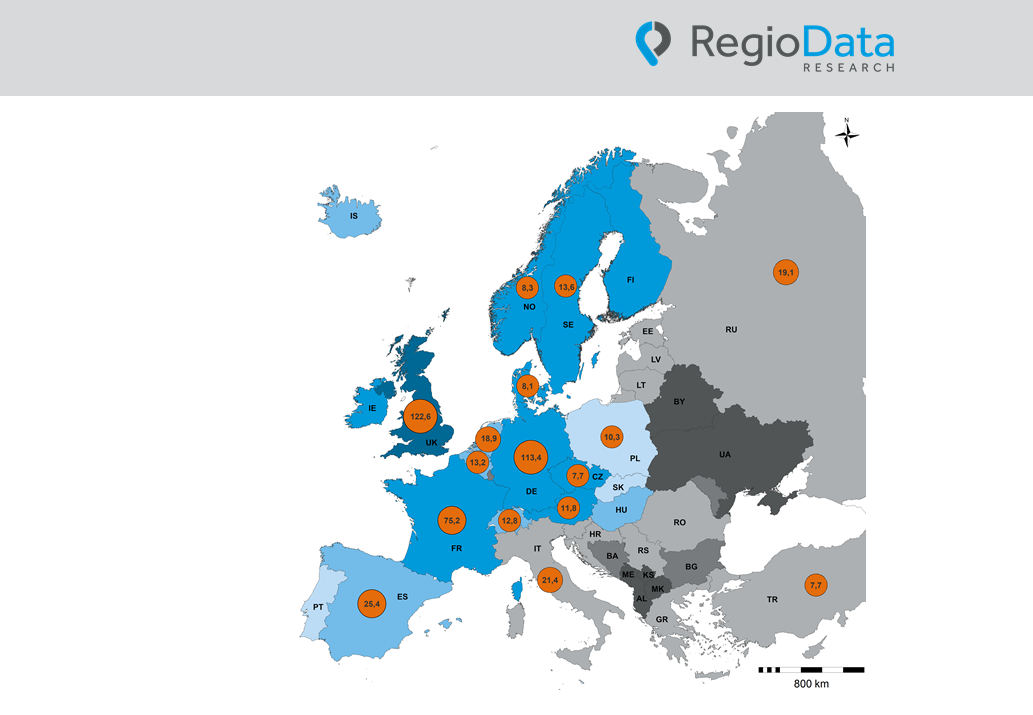

Internationally, too, the long-term triumph is unstoppable. While online shares of up to 40% of the total retail volume have already been achieved in some Asian countries, the online share in Europe currently still varies between 5% and 27%. On the European terrain, there is a clear northwest-southeast divide in this respect. In addition, the level of purchasing power and the density of stationary sales areas are relevant to the extent of online shares.

The UK, with its high purchasing power and low density of retail space, has by far the highest online share in Europe at 27% and thus holds a unique position. With a share of 16.2%, Austria is in the top third and can at least occupy fourth place in Europe, after the UK, Germany and Denmark.

Market leaders fail to expand market share

Although all-rounders such as Amazon, Zalando and the Otto Group have increased their overall sales, their market shares in the individual segments have stagnated. In addition, numerous specialists are currently gaining in importance and nibbling away at the sales of the all-rounders.

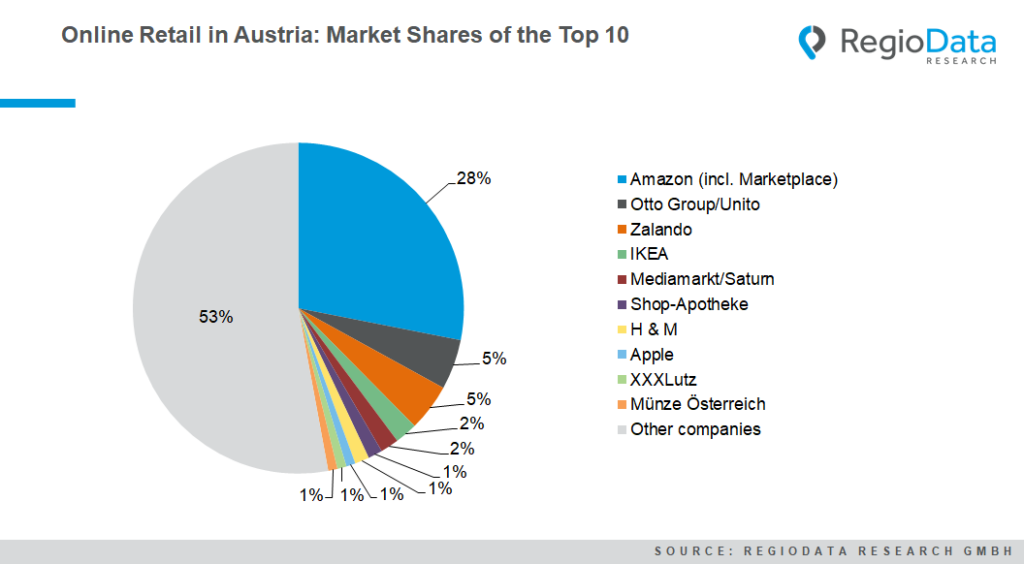

Nevertheless, the online market is mostly characterized by concentration trends. The big fish in online retail are either pure players like Amazon, Zalando, Shop Apotheke, etc. or very strong (stationary) brands like IKEA, MediaMarkt, H&M and Apple. For Austrian consumers, the following online stores make it into the top 10 (graphic in download).

Furniture and footwear retailers along with DIY stores catching up rapidly

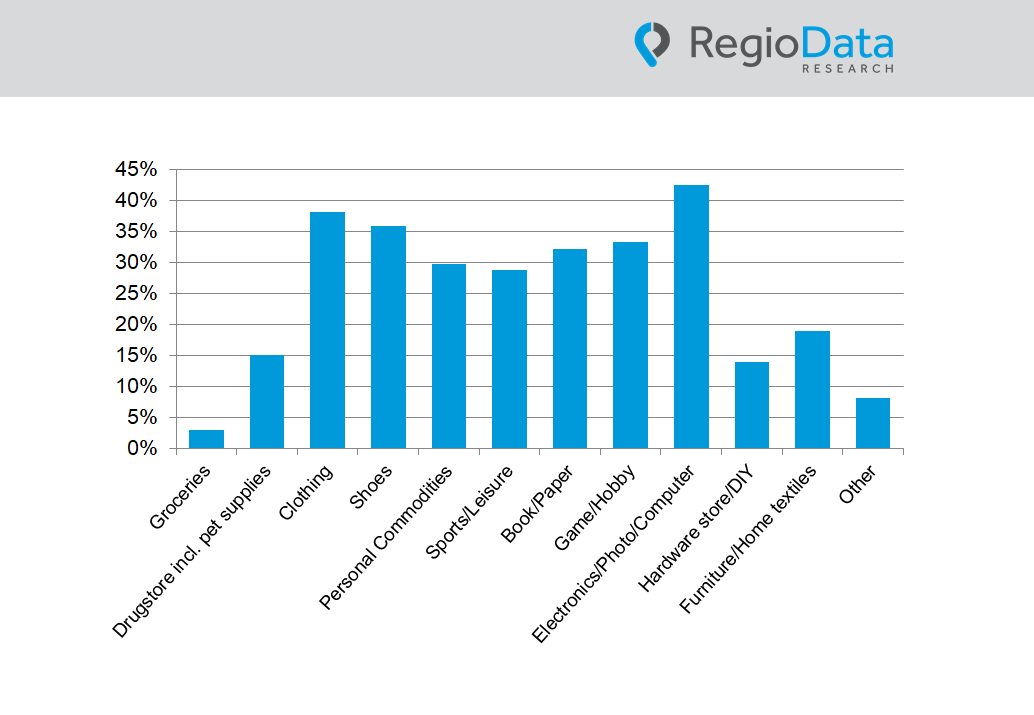

Online retail in Austria continued its growth course in most sectors in 2021. The highest jump in online share got scored by DIY stores, which increased by 1.6 percentage points year-on-year to 14.5%. The furniture and footwear markets also increased by more than 1 percentage point each. Electronics and clothing remained at a high level.

Nevertheless, there have also been declines in online shares: Slightly lower online shares can are obeserved in book retailing and the games, leisure, and sports sectors. With an online share of 2.8%, food retailing shows stronger momentum than in the previous year, but it still ranks last in the sector comparison.

Corona leaves a lasting mark on online retailing

In addition to many peripheral phenomena brought about by the pandemic, the long-term changes in e-business are particularly noticeable. The main consequences of online retailing are sharp increases in sales, especially in the food sector, and many new first-time buyers.

With adapted hybrid concepts such as Click&Collect, Billa and IKEA specifically have been able to fill online niches in the grocery and furniture retail sectors, thereby significantly underlining their market position. There has also been a progressive shift from mono-label stores to marketplaces. In addition, new online pure players such as Ringana and Gurkerl have ventured onto the Internet and are already raking in considerable sums in sales.

Even the global player “Münze Österreich”, which belongs to the world’s elite of mints, has now positioned itself as a multi-channel retailer in Austria’s top 10 online providers. The company now offers an online platform for investing, collecting, and giving investment coins and gold bars and is thus on the pulse of the times.

The design of the next generation in online retailing remains very exciting. There are already numerous approaches to live shopping, VR shopping, or even personal shopping – and there are probably no limits to creativity here!

Share post