austria

The store development of drugstore and perfumery retailers

The latest analysis of drugstore and perfumery locations in Austria, evaluated exclusively by RegioData Research, shows how drugstore retailers have evolved in the stationary market.

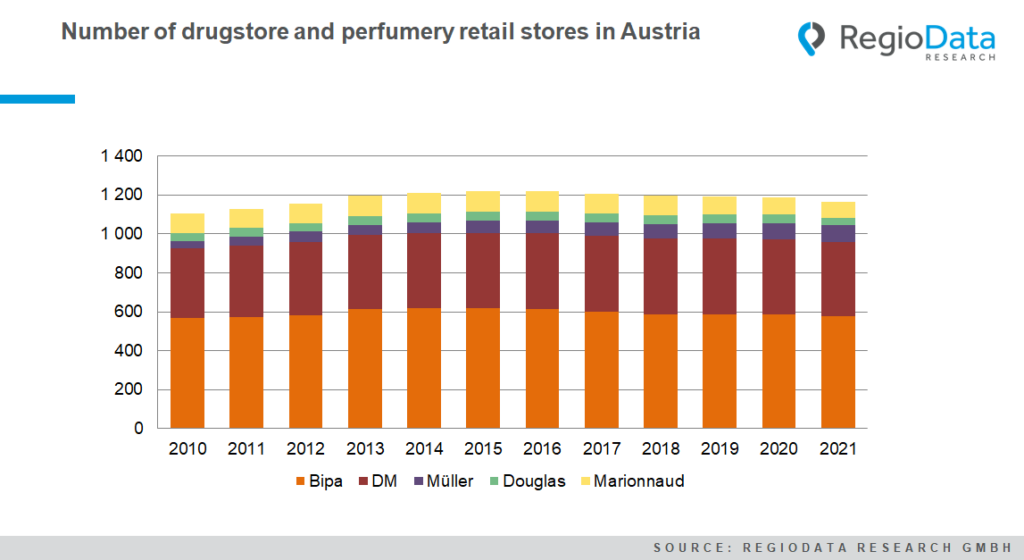

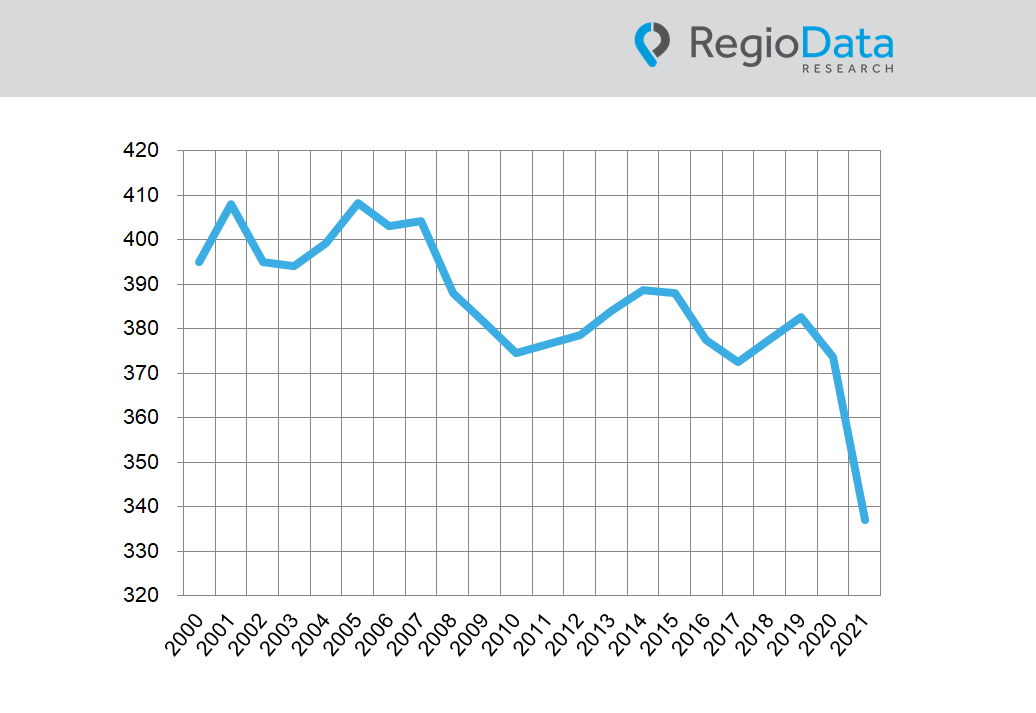

Over the long term, the total number of stores has declined slightly and – apart from the Schlecker shock with numerous closures in 2013 – has remained constant.

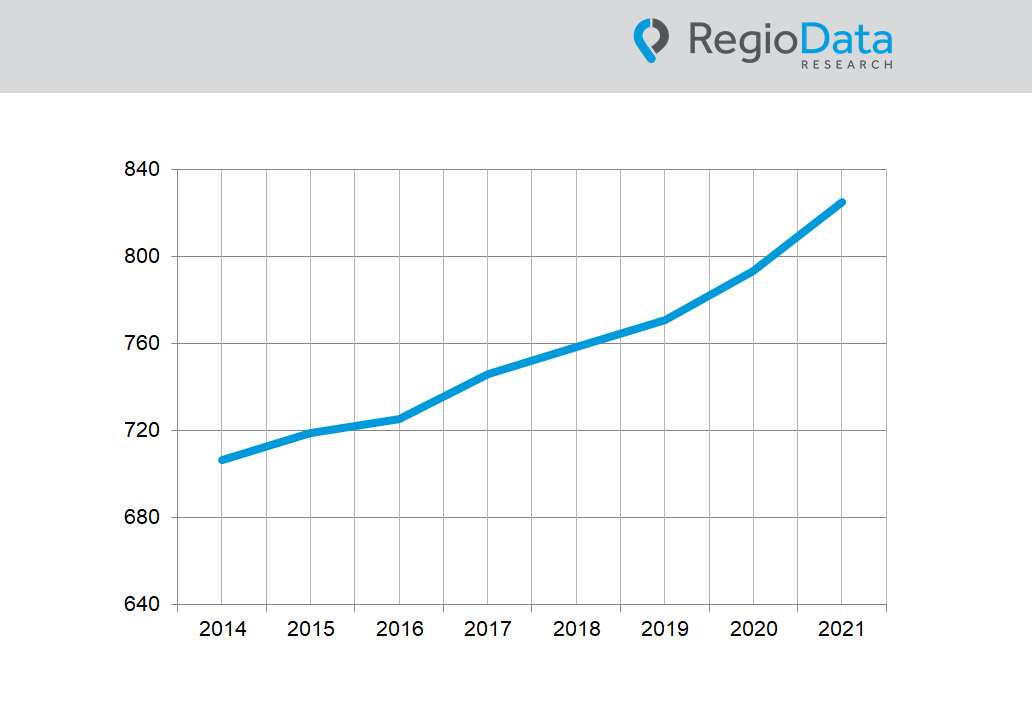

If we now look at the 10-year review, including non-franchised market participants, there is a recovery in sight from 2014 compared with the previous year. However, in the overall context, there is a constant “minus” of around 1,000 locations, which has hardly recovered to date. Since 2010, the number of sites has therefore fallen by a total of 35%.

While drugstore giant Bipa has shed 43 locations since the 2014 peak, the next big market player, dm, has remained virtually constant over the past 10 years. The development of Müller Drogerie also appears remarkable, with a doubling of locations – even more so with comparatively large sales areas – over the period of the last 10 years.

Pure perfumery stores are currently having a hard time, as fragrances and decorative cosmetics have been severely affected by online retailing and the Corona pandemic.

Similarly, Marrionaud has said goodbye to 26 locations after peaking in 2014. Meanwhile, Douglas has only been following the new corporate strategy since the Corona launch year of 2020, reducing the number of stores from 45 to 37 in the following year.

Overall, the dynamics of the “Top 5” in the Austrian drugstore market have changed very little. Bipa and dm continue to occupy the top of the mountain, bipa securing a significant lead with a total of 576 locations – almost 200 more than dm. Müller and Marionnaud rank well behind, having converged sharply in the past two years due to Müller’s growth on the one hand and Marionnaud’s decline on the other. In comparison, Müller had just one-third of Marionnaud’s 33 locations in 2010.

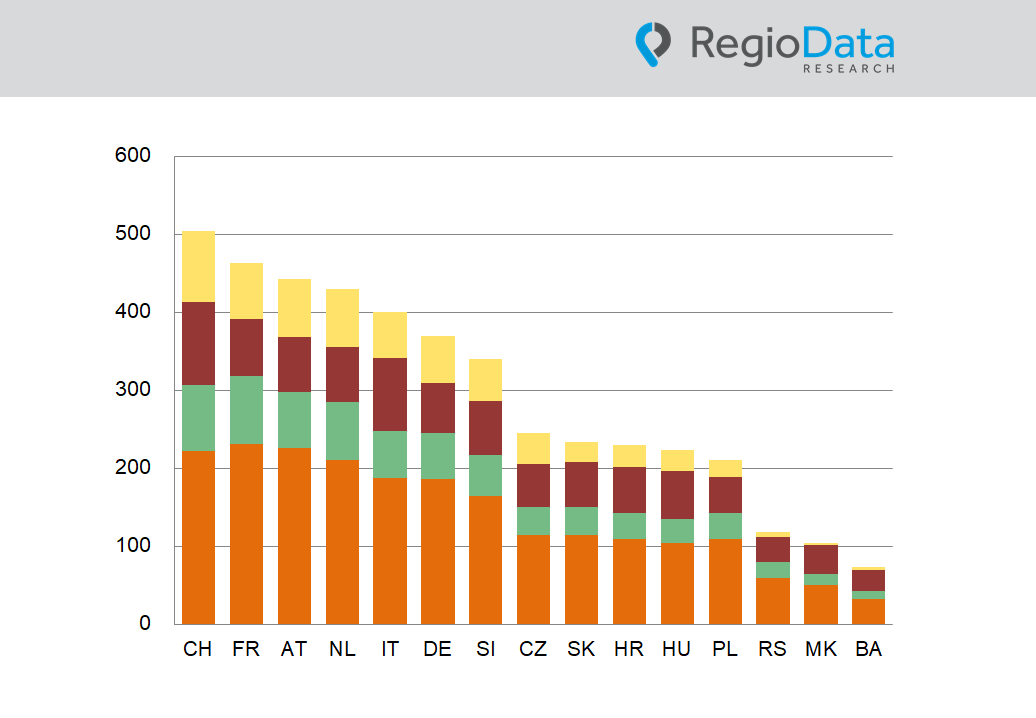

In perspective and the long term, however, the question arises as to the extent to which the stationary drugstore market can hold its own against online retailing – especially in virtual marketplaces.

share post