Austria

Furniture retailing prospers despite corona

In the current observation year 2021, the total furniture retail market was worth around 5.9 billion gross, corresponding to a nominal increase of 4.4% on the previous year.

Positive development can be expected to continue – not least due to the recently relaxed Corona measures. Annual spending by private households on the product groups relevant to the furniture trade rose by 3.9% last year, despite regularly imposed lock-downs, and currently amounts to €825.1 per inhabitant. As a reaction to the pandemic, so-called cocooning could be one of the reasons for the “furniture boom”.

Austrians invested in home furnishings in particular. Over the last five years, consumer spending on kitchen and bedroom furniture plus seating and upholstered furniture increased by around 15%. There was also a 10% increase in spending on room furnishings, including decorations, wallpaper, curtains, and carpets. There has been comparatively little growth in household goods, which include tableware, pots and pans, and all home textiles. Here, a minimal increase of just 1.5% is observed.

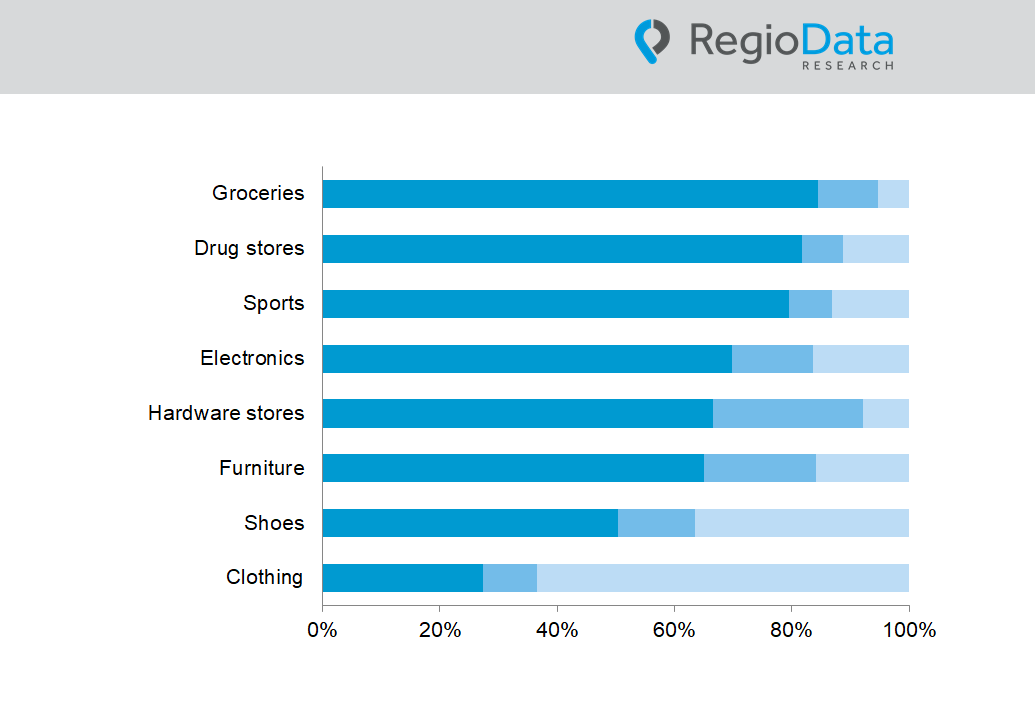

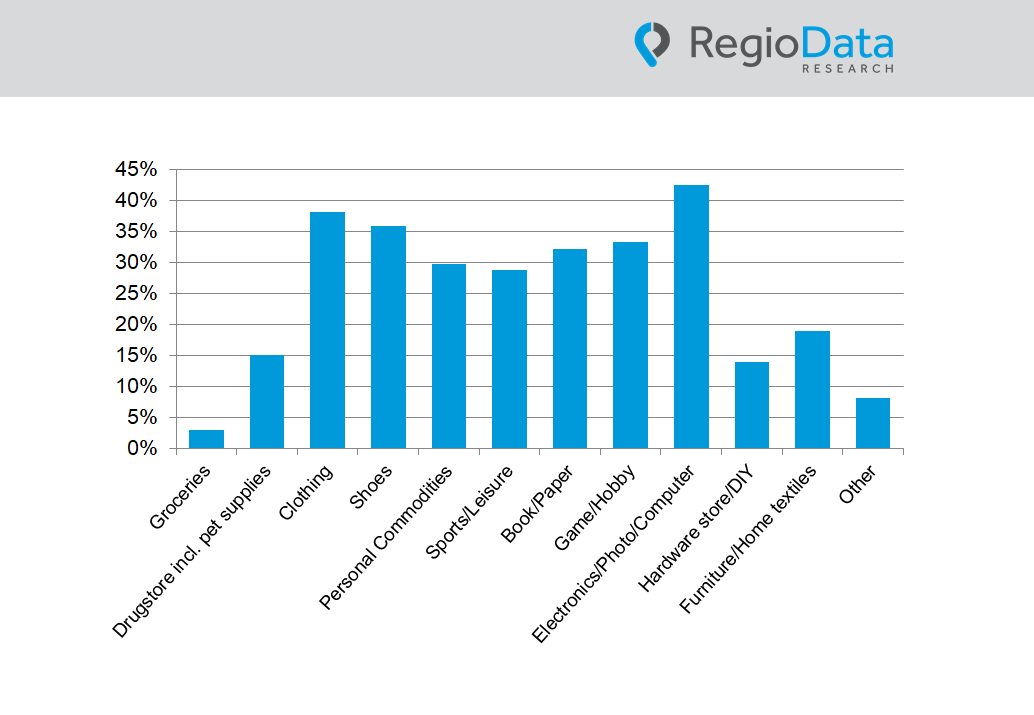

The rising expenditure relates in particular to the online share, which is currently around 19% of the total market. This includes sales from domestic and foreign online stores, pure players, and multi-channel sales by stationary retailers. Online furniture retailing is becoming increasingly popular due to its simple and rapid execution.

Retailers who have targeted multi-channel solutions in good time will be the first to benefit from the online boom. The major players in the stationary market already have established online shops. The high online growth rates of the last few years can thus be attributed to the increased activities on the part of the top 2 on the market, XXXLutz, and IKEA, but also the pure players such as Amazon and Unito. IKEA, in particular, is by far the most successful online furniture retailer, and this year for the first time has catapulted itself into second place in the overall Austrian furniture market. Therefore, further increase in online shares is to expect.

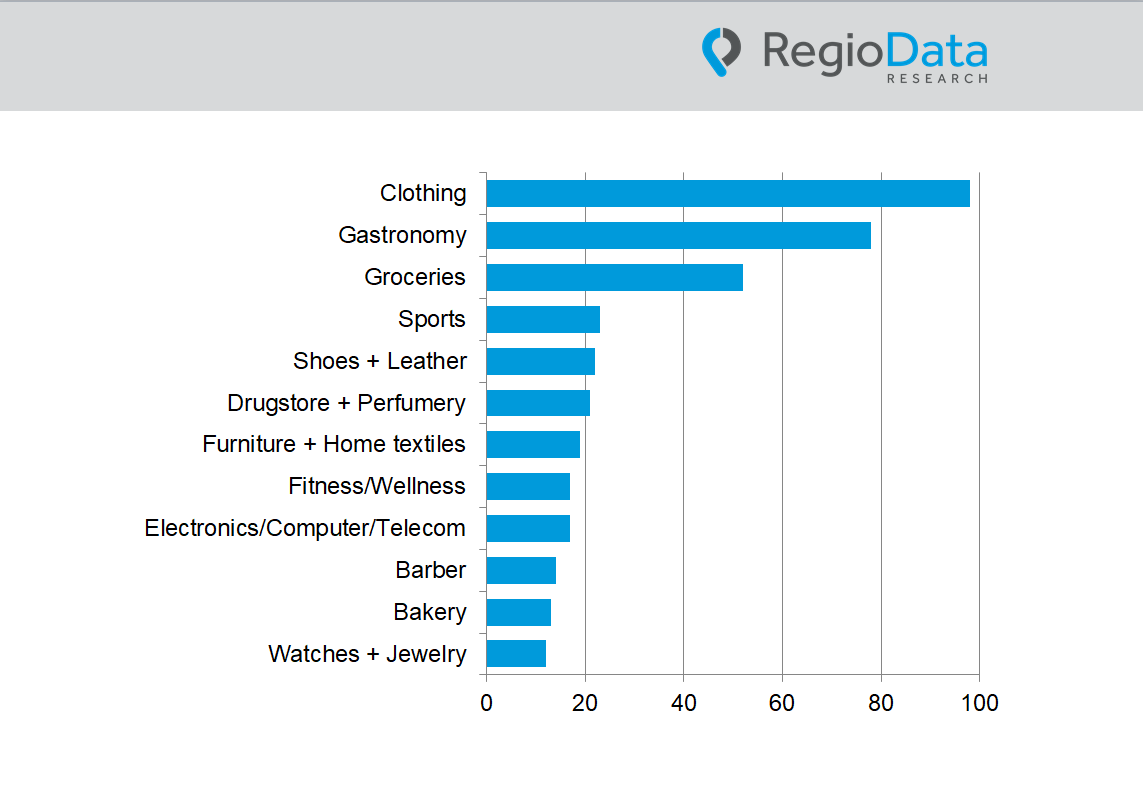

Although furniture retailing is a fiercely competitive industry, the gap between the market players is also very significant. For example, the three market leaders (XXXLutz, IKEA, and Kika/Leiner) combined cover around 65.0% of sales in Austrian furniture retailing.

Despite optimistic forecasts, the overall economic situation could quickly change and weaken due to the still unknown pandemic, strained supply chains, and the enormous price increase, which could torpedo growth and private consumption.

Share post