Austria

Clothing retail in upheaval: Discount stores on the march

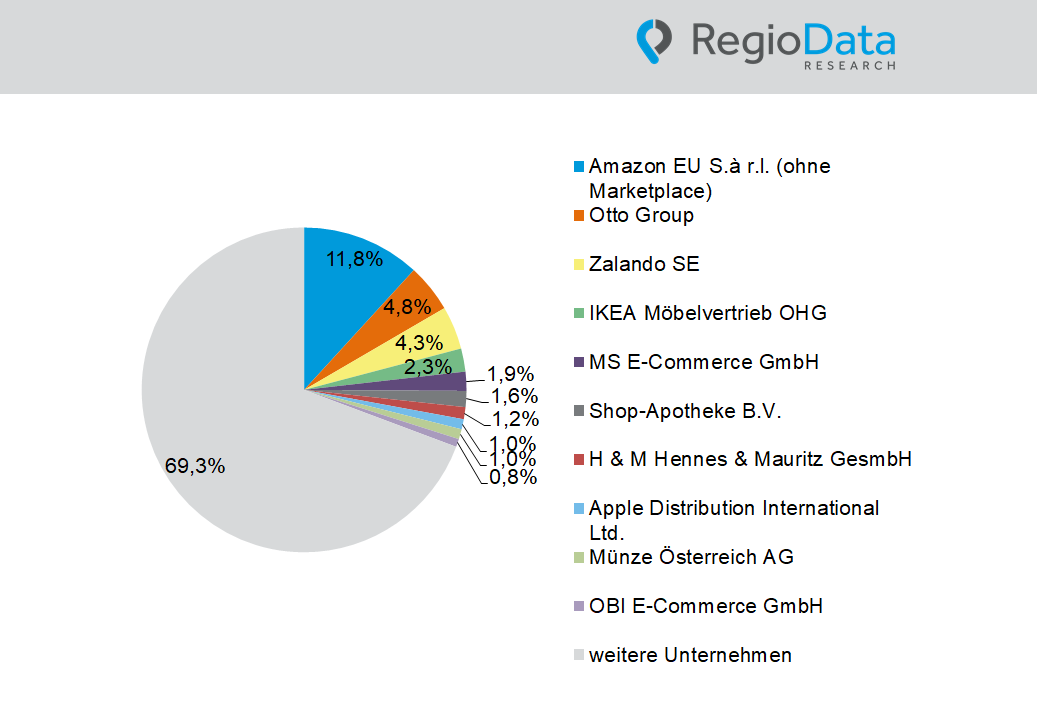

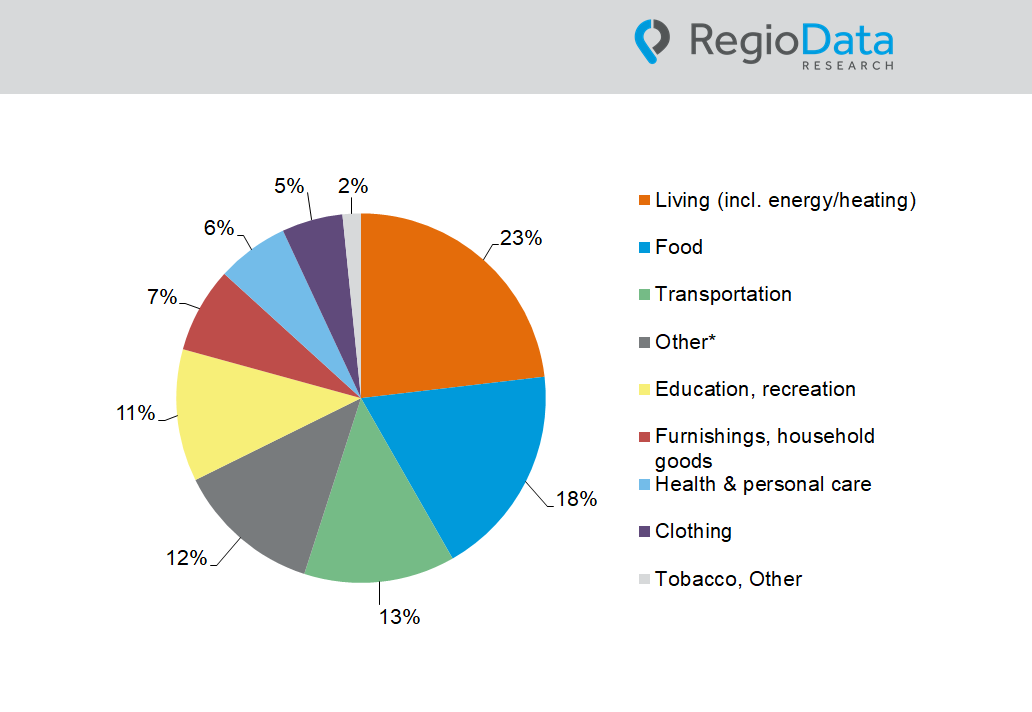

In 2022, sales in the stationary clothing retail sector amounted to around 5.1 billion (gross), representing nominal growth of + 19.7% on the previous year. However, the situation that stationary store locations are under strong pressure, especially from the online market, has not changed in the current year. It is striking that many discount-oriented sales divisions appear to be hardly affected by this problem.

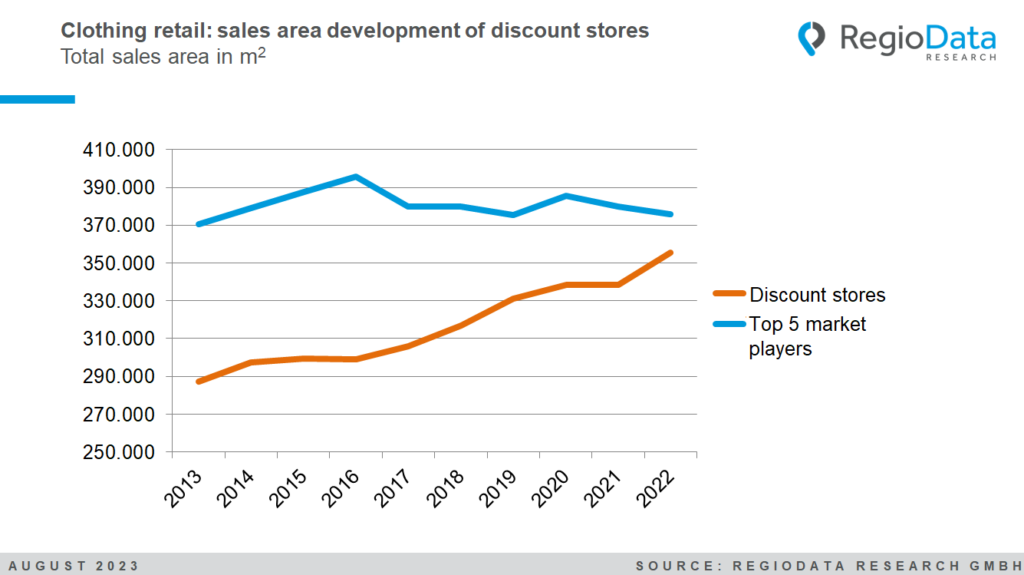

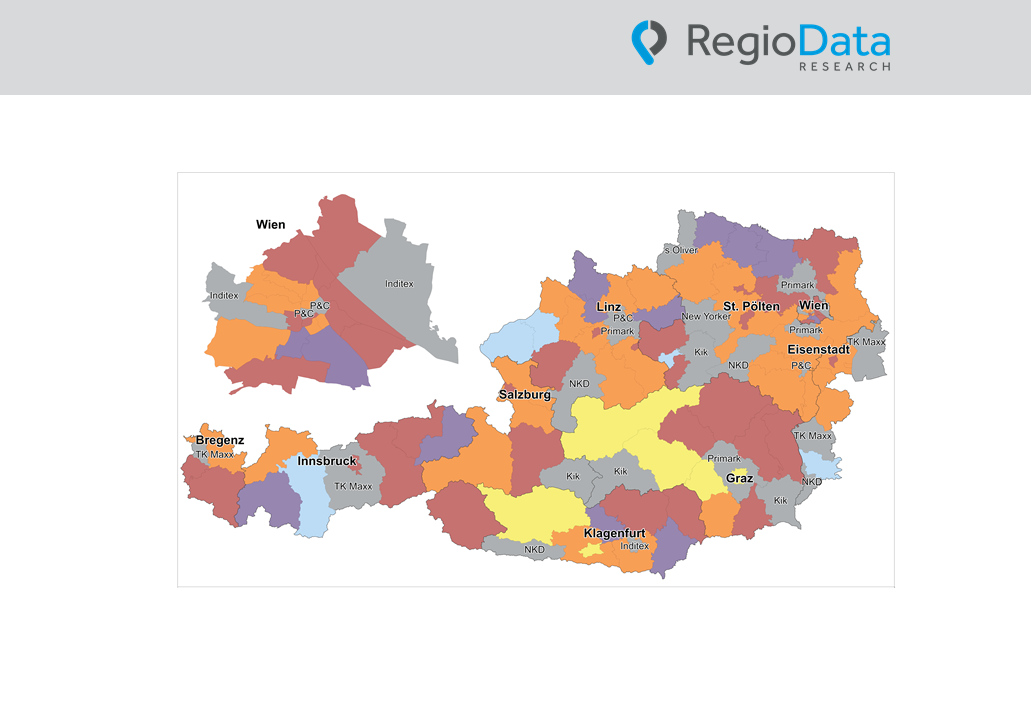

Discount retailers have been in a flourishing phase since 2017. In total, the largest companies in the low-price segment (referred to as “discounters” below) – Ernsting’s family, NKD, Pepco, Primark, Takko, Kik, and TK Maxx – have seen a 16.3% increase in sales areas over the last five years. Alone, Ernsting’s family has recorded a growth of 25% since 2017. Generally, all discounters, except Takko, have significantly expanded their sales areas over the years. Among the new openings in 2022, Pepco led with 35 new branches, while NKD opened 10 new branches.

When including all other market participants, the total retail space in Austrian clothing retail remains relatively unchanged, albeit with a declining trend of approximately -1.5% per year. In general, a trend of closures rather than new openings is more evident. Orsay closed all existing 50 branches. Tally Weijl had to close 9 of its locations and currently operates only 22 branches.

In contrast to the discounters, the “Big 5” – H&M, P&C, C&A, K&Ö, and Zara – have been experiencing a phase of stagnation in sales areas for several years, even with a decreasing trend. The challenging situation faced by stationary clothing retail is further emphasized this year by the financial difficulties of renowned companies, such as Gerry Weber and Hallhuber.

Looking ahead, the clothing retail industry will continue to face the well-known challenges: the ever-growing presence of online commerce, shifting consumer habits, and competition from discounters.

share post