austria

Retail space - Austrian cities are "overstored"

The current RegioData analysis shows: Although the retail sales areas in Austrian retail have been continuously declining for over a decade, it is primarily many medium-sized cities that have disproportionately high numbers of retail spaces. However, the changed conditions due to online commerce and consumer restraint are expected to lead to further declines in retail areas.

14 million square meters of retail space in Austria

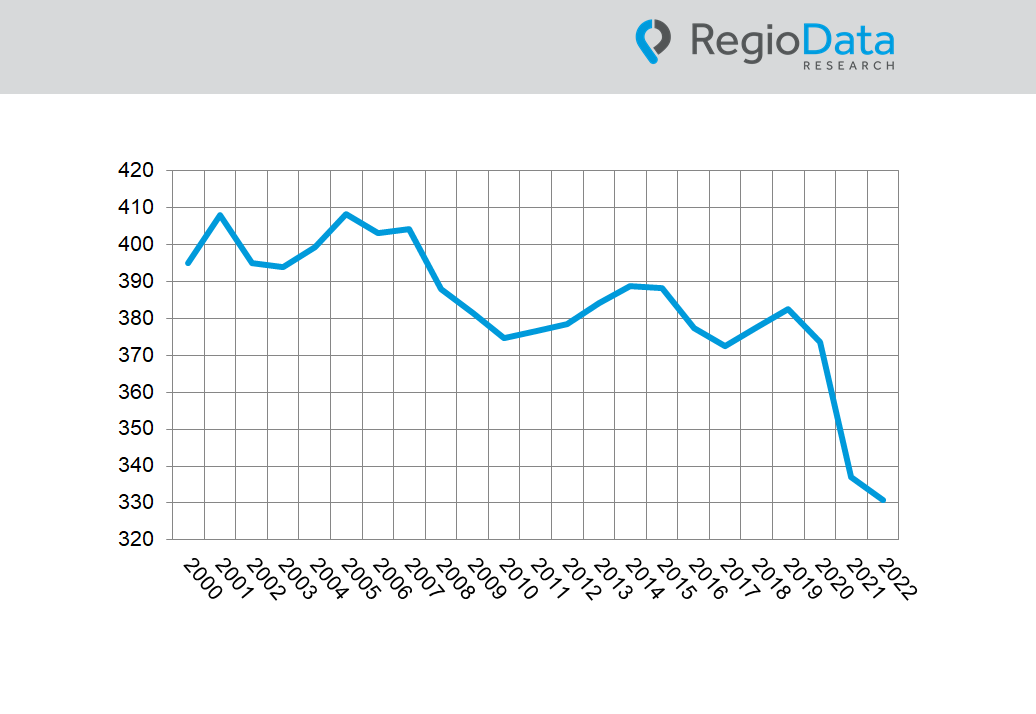

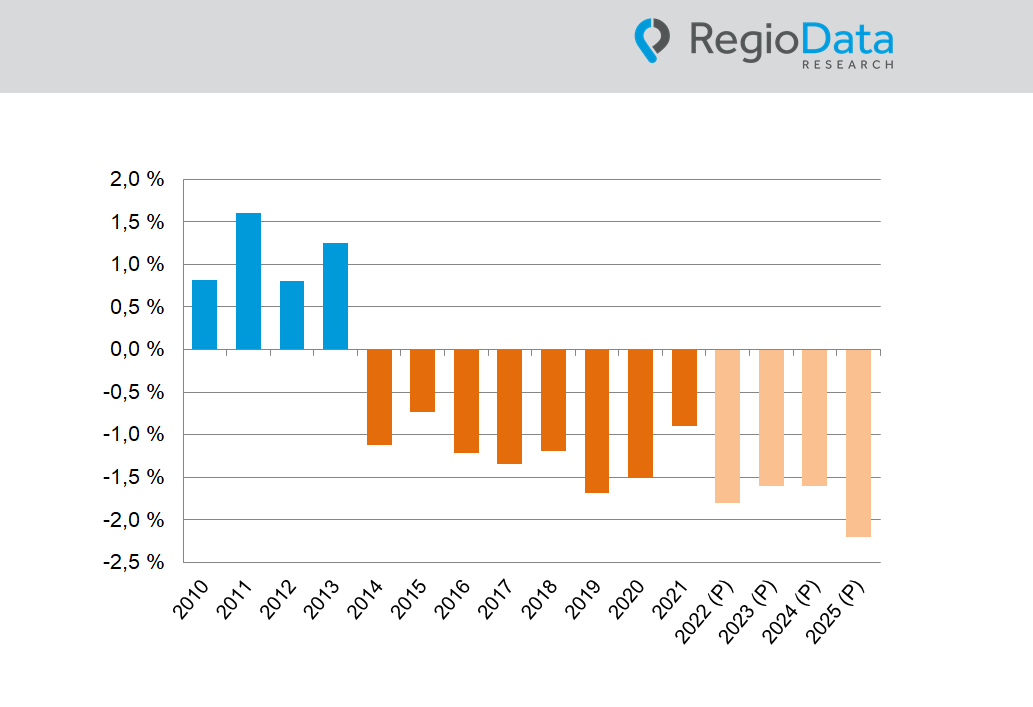

Austria has an exceptionally high density of retail spaces compared internationally. However, since the departure of Schlecker in 2013, the brick-and-mortar retail sector has been experiencing losses in sales areas. This decline is occurring slowly but continuously. Currently, there are approximately 1.56 m2 of retail space available per inhabitant, compared to 1.67 m2 in 2017, and even 1.77 m2 in 2014.

The main reason for this decrease is likely a combination of factors, such as the rise of online commerce, increasing rental, labor, and energy costs, as well as changing consumer habits. In response to these changes, companies in the brick-and-mortar retail sector have had to adapt and reduce their sales areas to be economically more viable. Reducing the retail spaces allows these companies to cut costs while still meeting the needs of consumers who are increasingly shopping online.

Regionally very different development

Now, sales areas are steadily retreating, although this process varies greatly from region to region. Among cities with over 25,000 inhabitants, for example, Wiener Neustadt has the highest retail space density in all of Austria, with nearly 7 m2 per inhabitant, while Vienna only has 2 m2 per Austrian.

The available retail space has little correlation with peripheral shopping centers and is also not strongly related to current vacancies. An example of this is seen in the top 2 cities, Wiener Neustadt and Wels. Despite both having an extremely high retail space density, Wiener Neustadt has a particularly high vacancy rate, while Wels has a very low vacancy rate. This demonstrates that a large retail space does not necessarily correlate with low vacancies, as it is influenced much more by the city’s structure, catchment area, and many other factors specific to each city.

In general, high retail space density is mainly found in medium-sized cities because these cities can tap into the potentials of the surrounding areas. The largest cities, such as Vienna and Graz, do not actually have as high retail spaces as one might assume.

Outlook

It is highly likely that the retail spaces will continue to shrink overall. This decline will progress slowly but steadily, at a rate of approximately 1.5 to 2.0 % per year. It is essential to note that all locations will be affected, including city centers, shopping malls, and retail parks. This trend is mainly attributed to the most significant challenger: online commerce as a “game-changer.”

Share post