Austria

Online retail: Declining figures for the first time - Top 3 lose market share

The brand-new edition of the “RegioData Online Retail – Austria” study is out and reveals the results: Austrian consumers currently invest around 11.2 billion euros a year in their online purchases, which equates to around 1,250 euros a year per inhabitant. Although this amount is almost twice as high as it was six years ago, online retail has suffered declines for the first time this year. However, this is by no means a trend reversal!

Temporary catch-up demand in online-retailing

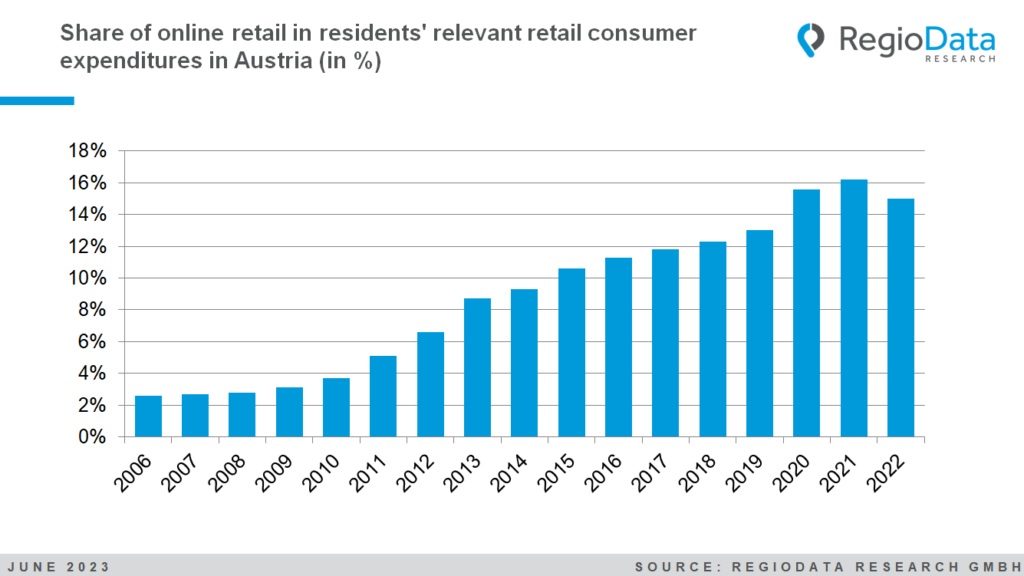

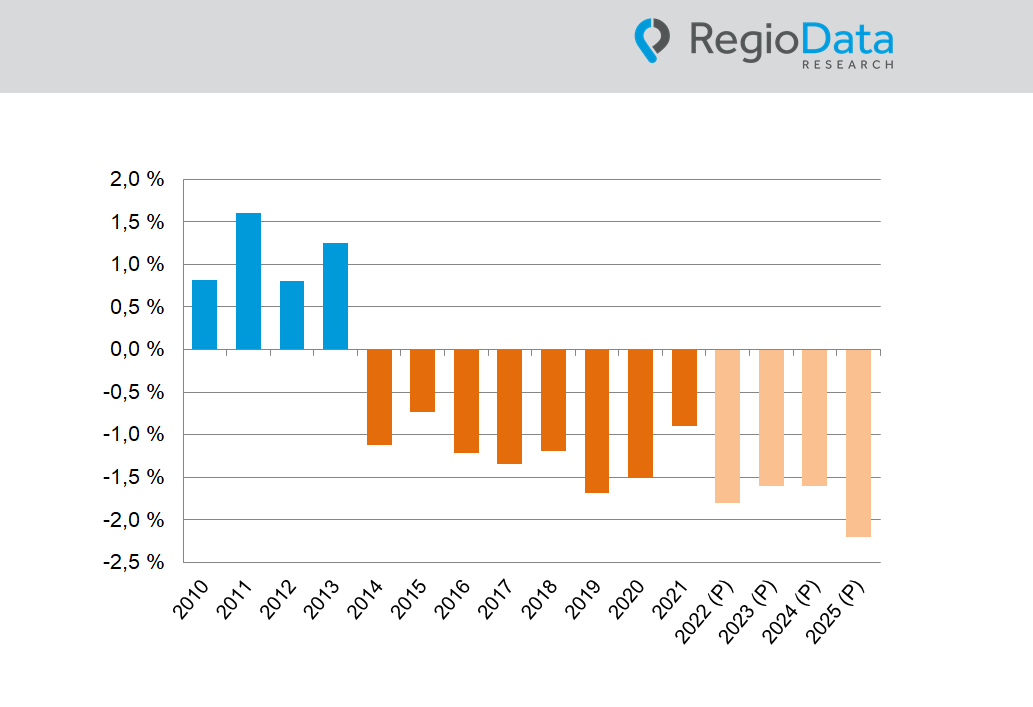

Since its inception, online retail has shown significant growth rates, always exceeding the respective inflation rate. In 2022, however, there was a sobering shift: The online share of consumer expenditures decreased from 16.5% to 15.0%.

This is, of course, related to the fact that the COVID-19 pandemic had boosted online retail. The growth rates during the pandemic years were significantly higher than the long-term trend.

Currently, brick-and-mortar retail is celebrating because there is a catching-up demand, but the current situation is deceptive. In the current year, online retail will resume its steady rise and surpass the pre-pandemic level by 2024. In the medium term, it is expected that, at least excluding groceries, the online share will reach 50% of total consumer expenditures. In some sectors such as books, toys, and electronics, this is already the case in certain subsegments.

(The share of online retail is calculated based on the annual accumulated company revenues in relation to the total consumer expenditures of private households.)

The top 5 remain unchanged at the top

The “Big Five” online providers have maintained their positions in the same order of precedence this year, dominating a quarter of the entire online industry in this country. With a market share of 12%, Amazon (excluding Amazon Marketplace) remains the undisputed number 1 on the web. Added to this is a further 17% for its own marketplace. The Otto Group secures second place with a 5% share of online retail. Zalando follows in third place, contributing around 4% of online spending in Austria. IKEA – as the largest multi-channel retailer – takes fourth place with a market share of just over 2%, while MediaMarkt takes fifth place at just under 2%. Other companies in the top 10 include Shop-Apotheke (1.6%), H&M (1.2%) and Apple (1.0%). XXXLutz made it out of the top 10 this year, but Obi gained market share and secured tenth place with just under 1%.

The market leaders have lost market share

While the market’s momentum was maintained, the market leaders had to face significant setbacks last year: While IKEA and MediaMarkt were able to make slight gains, the top three players (Amazon, Zalando, Otto Group) not only lost market share but also experienced a decline in nominal revenues. Among them, Zalando suffered the biggest setback. The apparel giant’s market share has decreased from around 5% in 2021 to approximately 4% at present.

Online Shares: Austria remains in the upper midfield

While China has managed to increase its online share to an impressive 48% (!) after reaching a peak of 42% in 2021, the online share in Europe still ranges from modest 5% to 27%. The top-ranking country in Europe remains the United Kingdom with a 27% online share. Germany and Denmark, occupying the second and third positions in Europe, have experienced slight declines in their online shares. In Austria, online retail accounted for around 15% of retail-related consumer spending in 2022, closely followed by France, the Czech Republic and the Netherlands, for example.

Downward trend in the clothing sector

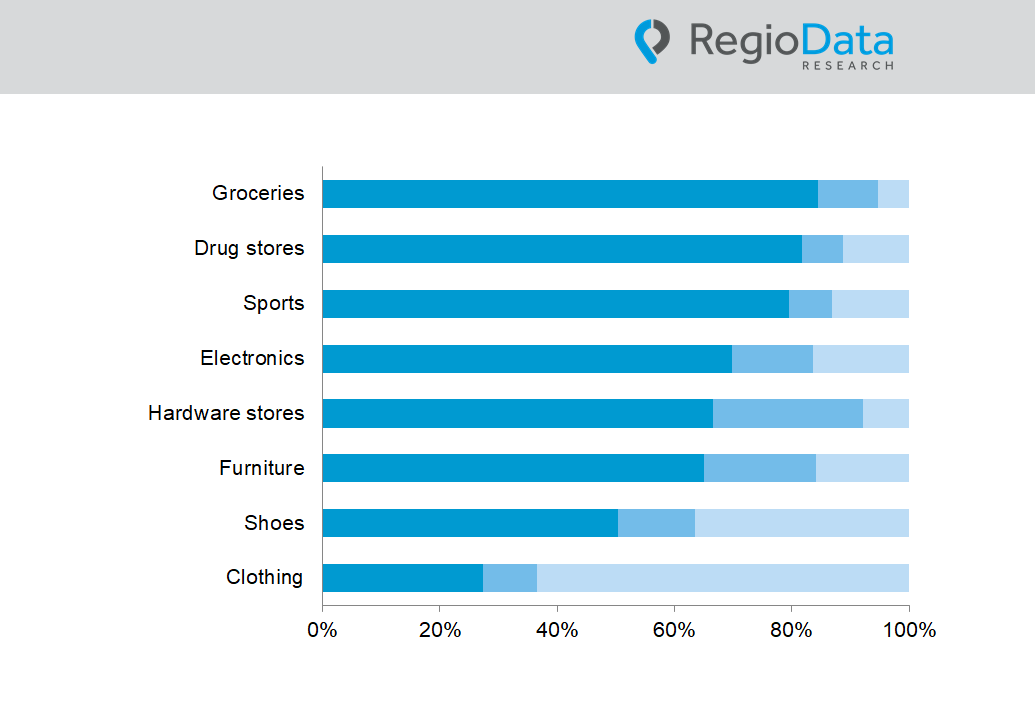

In industries with products primarily catering to medium-term needs such as clothing, shoes, electronics, and books, the online share of private consumer expenditures already ranges from 30% to over 40% (measured against residents’ consumer expenditures), with the electronics sector still holding the highest position with a 44% online share. However, after the COVID-19 pandemic, a stronger decline in the online share has become apparent, especially in the clothing and shoes categories. The online share in the clothing industry alone has decreased by 9% compared to 2021, while shoes have seen an 8% decline. In the short-term needs category, such as groceries and personal care products (FMCG), the online share is currently still very low. In the long-term needs category, such as furniture and DIY products, the online share is currently around 13% and 17%, respectively, but the highest growth rates are expected in the medium term.

34 % of expenses remain in the home country

Currently, only 34% of the expenditures made by Austrian consumers benefit domestic companies. Before the pandemic, this figure stood at 36%. As a result, the relevance of domestic online shops is decreasing. The remaining portion goes to foreign companies. The largest domestic online companies are Unito (a subsidiary of the German Otto Group) and MS E-Commerce (a subsidiary of the German MediaMarkt-Saturn Group).

Observable trends 2022

In 2022, there was a decline in online food delivery. Austrians spent approximately 6% less on their online food orders. One significant external influence is the COVID-19 pandemic. Consumers may have chosen to reduce their online food ordering and instead returned to local shops or supermarkets.

An interesting development in 2022 was the increased use of online shopping, especially among young target groups, who conducted even more of their purchases online than before. The significant shopping behavior of younger generations will have a lasting impact on both the brick-and-mortar and online worlds. The trend is clearly visible. In terms of total shoe sales, Zalando, as a pure online player, has already become the second-largest shoe retailer in Austria, trailing only Deichmann.

share post