Austria

Concentration in the austrian retail sector continues to intensify

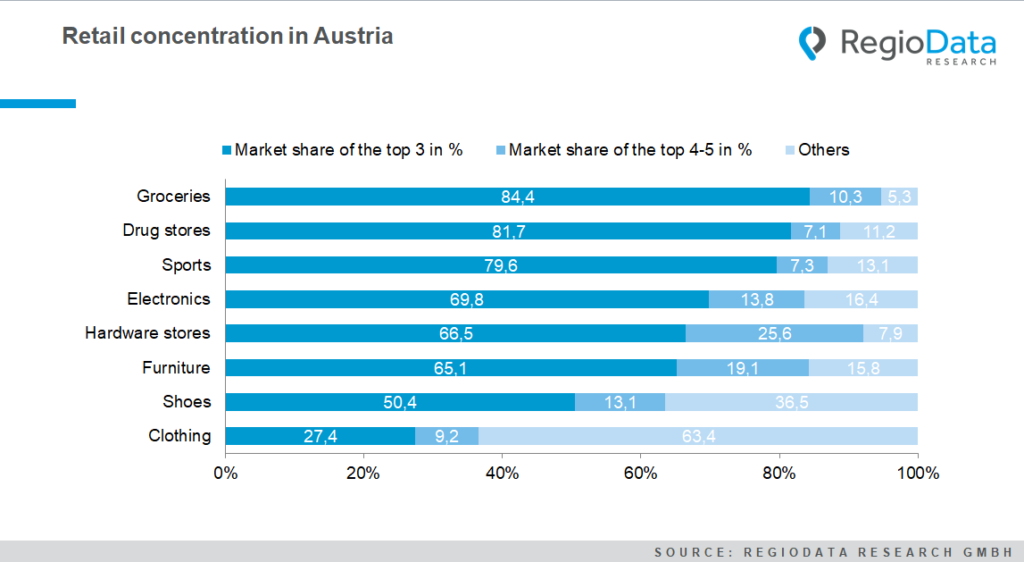

The well-known high level of Austria’s market concentration prevailed during the Corona-Pandemic, as the major players continued to make inroads. Particularly in food retailing, sports retailing, and drugstore and perfume retailing, few market players control almost the entire sector.

Top 5 grocery retailers achieve 95 % market share

Compared to other sectors, stationary food retailing has the highest market concentration. The five largest retail companies in Austria already account for 95% of the total market volume. Internationally, such degrees of concentration have so far only been measured in Switzerland and Scandinavia.

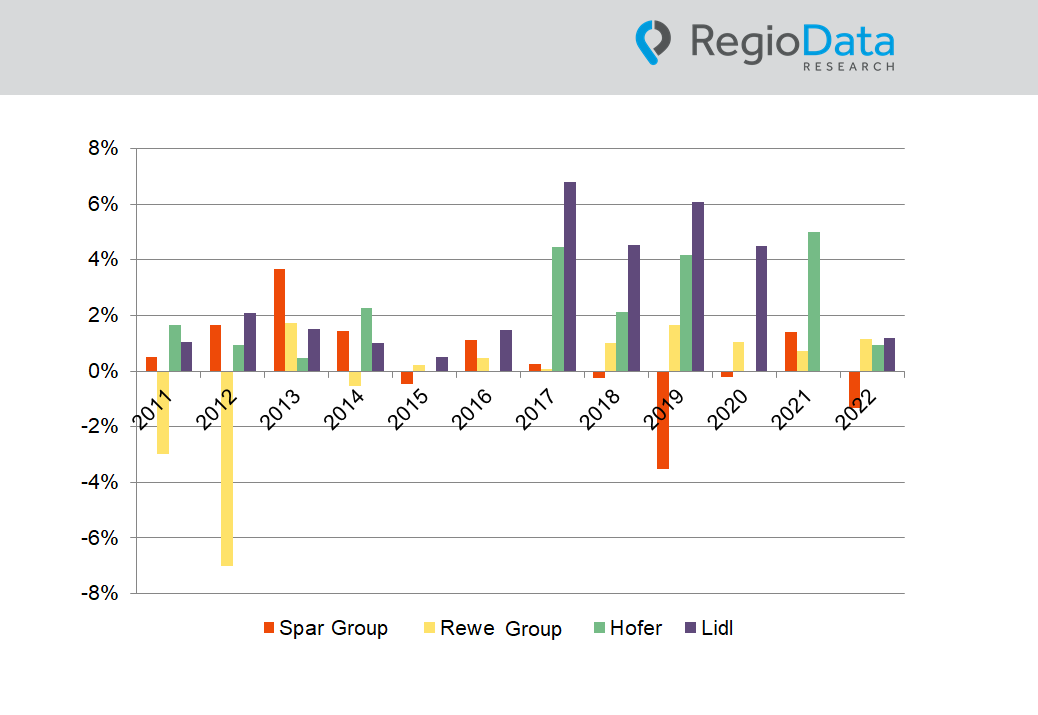

Together, REWE, Spar, and Hofer account for 84% of food retailing. The “Big Three” have maintained their supremacy for over a decade. The REWE Group currently runs the most stores in Austria, closely followed by Spar. Hofer has also increased its number of stores considerably in recent years, securing third place in the food market. With over four-fifths market dominance, the top 3 serve enormous consumer volumes and are indispensable in today’s stationary market. The e-food market has somewhat more room to maneuver. Although Rewe and Spar will soon occupy 50% of online retail here, other providers could also secure an attractive place in the local supply market. Pure online supermarkets like gurkerl.at, Alfies, and others are increasingly fighting for market share.

Almost all industries show increased concentration tendencies

In six of the eight sectors examined, the five leading retailers hold more than 80% of the market, while the rest have to settle for the leftovers. And even if growth in the form of acquisitions or expansions is hardly considered possible in this exhausted market position, individual market players continue to grow organically and thus gain even more dominance.

According to the latest RegioData survey, it became apparent that the degree of concentration is developing differently from sector to sector. Virtually, all big players reinforced their dominant role by a further 1 to 3 percentage points. By contrast, both food and furniture retailers are stagnating – at a very high level. The top 4 and 5 companies in the furniture market even managed to increase their market share by 7%. Meanwhile, smaller suppliers are all suffering constant losses of market share.

Competition in the non-concentrated clothing retail

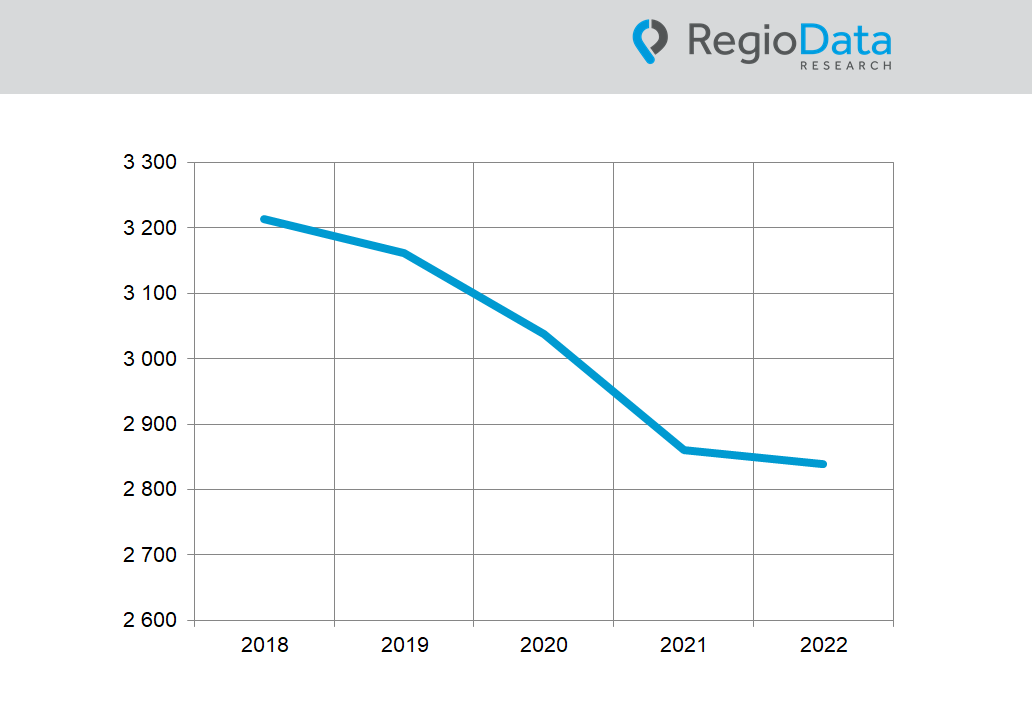

The Austrian clothing market is characterized by two features. On the one hand, there is still a very high density of sales space compared with the rest of Europe – despite many store closures – and on the other hand, the market leaders have by far the lowest concentration compared with the other sectors. Companies with several sales divisions, such as those in the food and sporting goods sectors, are hardly represented here. In addition, clothing retailing is naturally very diversified and, therefore, fragmented in terms of the range of goods on offer. Dominating large textile department stores such as those in Germany or the Scandinavian countries are largely absent in Austria. Online retail, which is already very well established, further complicates the situation, as hardly any growth is permitted, and stationary retail must subsequently record declines in sales.

While consumer spending in the grocery sector is 84% certain to flow into one of the “Big Three,” the textile retail counterpart – H&M (incl. COS), C&A, and Peek&Cloppenburg – cannot even claim 1/3 of sales. Even with the fourth and fifth-placed KiK and Zara included, these five strongest market players can only claim a market share of 36%.

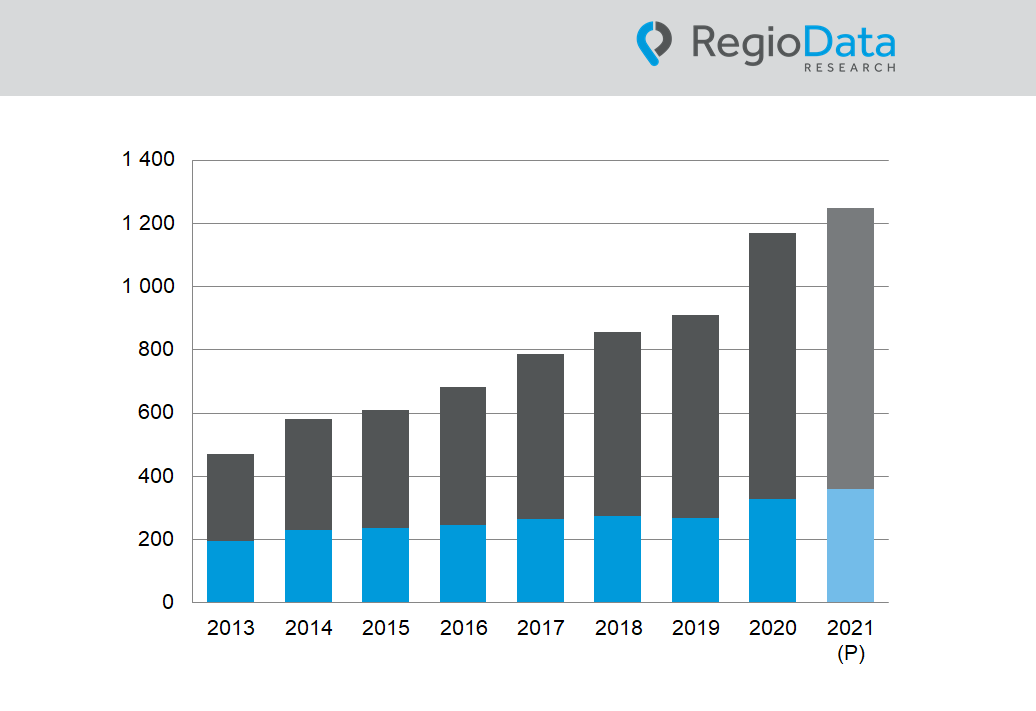

The driving force behind the reduction of concentration is the increasing number of pure Internet companies and virtual marketplaces such as Amazon and Zalando. Five years before, online accounted for around 20% of apparel spending. This figure – fueled by Corona – is currently close to 40%. While retail via the Internet is developing well, the sales areas in stationary clothing retail are on a clear and continuous downward trend. In recent years, clothing chain stores have repeatedly withdrawn from large-scale prime locations, thus cleaning up the market.

Cheap-jack: in between two fronts

Discount stores are becoming increasingly important in many sectors. Especially in the clothing trade, textile discount stores have expanded their locations considerably. NKD and Kik, for example, have the highest number of stores in Austria. Even at the start of the pandemic, the location giants thrived considerably.

In terms of sales, however, the low-price providers only made it into the top 10. In addition, the non-food discount giants Action, Pepco, and Tedi are benefiting considerably from the decline in purchasing power for individual population groups in Austria and are also attacking the established food discounters.

Share post