italy

Drugstore upswing - dm continues to climb the stationary market

The household expenditure on drugstore and perfumery products has been steadily increasing in Italy in recent years, with the exception of the year 2020 due to the COVID-19 pandemic. Now, the dynamic market is experiencing a tremendous leap forward. The retail sector for drugstore and perfumery products currently generates approximately €7.5 billion in sales. Overall, the drugstore and perfumery industry (including all expenditures on relevant product categories, regardless of their primary purpose or distribution channel) achieved gross sales of approximately €23 billion in the current observation year of 2022.

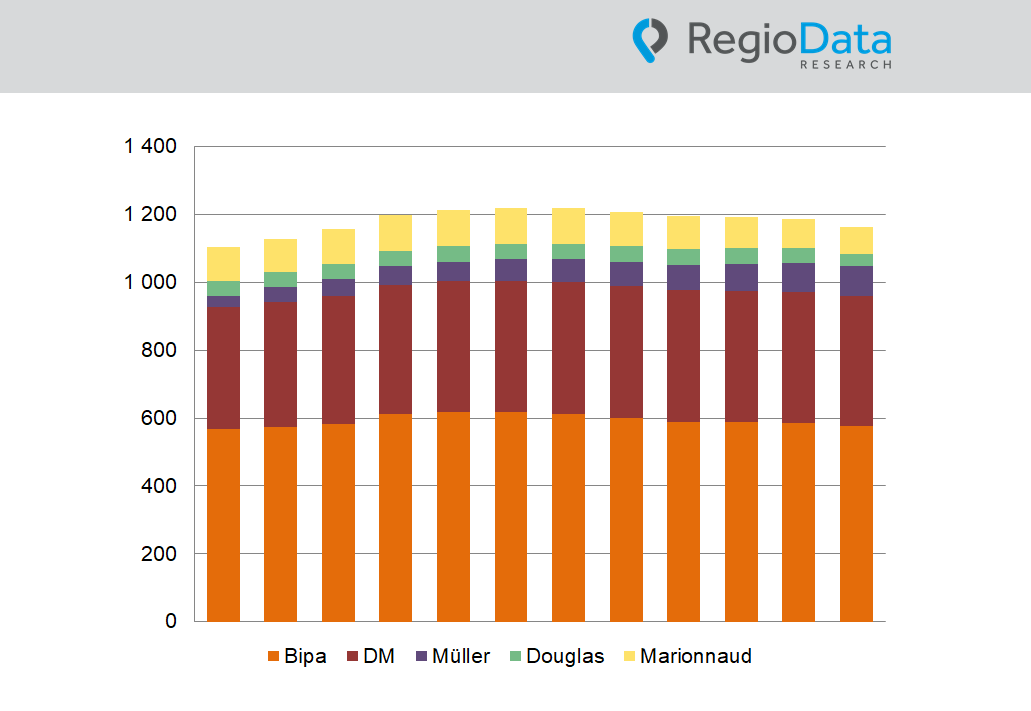

Among the dozen distribution channels, drugstores account for around 20% of the total market and are generally becoming more established, recording constant growth every year. Even during the Corona pandemic, the drugstore market proved its resilience to the crisis. Between 2022 and pre-crisis levels, impressive sales growth of around 24% was recorded here. Currently, the perfumery distribution channel accounts for around 10 % of the overall market.

The current high-flyer among drugstore retailers is dm. Since entering the Italian market in 2017, the drugstore giant has been able to achieve sales and retail space growth every year, and in 2022, they have already surpassed the €100 million revenue milestone. The perfumery sector, after experiencing a stagnant phase during the COVID-19 crisis, has resumed stronger growth and has shown a reasonably good development in 2022. With total revenue of around €2.4 billion, the perfumery market has finally reached its pre-crisis level again.

The largest perfumery chain in Italy is currently Douglas. With a market share of around 7% in the overall drugstore and perfumery retail sector, the perfumery chain currently occupies third place among the market leaders. However, Douglas is increasingly moving towards online business, which now accounts for around 15% of its sales.

The Acqua & Sapone consortium, which consists of 8 companies, holds a dominant position in the market and is the absolute market leader. Tigota, as part of this consortium, is the second strongest company in the sector. Together, these two brands control around 40% of the total market and operate around 1500 stores throughout Italy.

Additionally, the consumer spending of the Italian population has increased by approximately 14%. Similar to Austria, the expenditure on milk substitute products in Italy has nearly quintupled since 2019, which corresponds to an increase of around 500%. The “pet boom” during the COVID-19 pandemic is also reflected in the pet supplies sector, where there is now a 25% increase in spending on animals and related products.

Overall, drugstore and perfumery retailing in Italy continues to offer a promising future, characterized by innovation, digital transformation and keeping up with consumer trends.

share post