Austria

The rise of the non-food-discounters

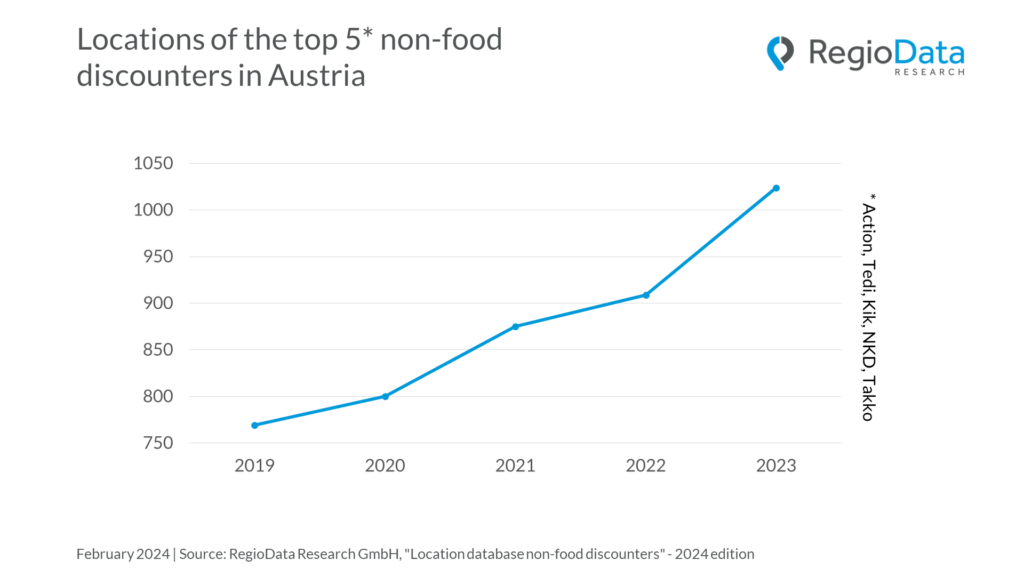

The expansion of non-food discounters in Austria is impressive! The current evaluation by RegioData Research on the discount market in Austria illustrates how the retail chains in the non-food sector have developed in recent times.

The leading non-food discounters in Austria, including Action, Tedi, Kik, NKD, and Takko, have experienced consistent strong growth over the past years, collectively establishing a significant presence with over 1,000 locations across the country. Remarkably – and somewhat surprisingly – is the speed at which these discounters are expanding. While almost all retail segments had to take a breather or even retract during the COVID-19 pandemic, the discounters continued their expansion trajectory and experienced a steep rise in a short period of time.

Perhaps the most significant growth is seen in the discounter Action, which was completely unknown in Austria just ten years ago but now has 140 locations. Tedi currently operates 180 locations, up from 135 in 2019. Additionally, there are Kik, NKD, and Takko with a combined total of 700 more locations.

A notable expansion dynamic is also demonstrated particularly by Pepco among other players in the market. Since entering the Austrian market in 2021 with 29 stores, the European company specializing in household and clothing assortments has expanded to 59 locations. Similarly, aus&raus has shown a strong presence with the opening of 17 Austrian stores in 2022. In the same year, the German family-owned company Thomas Philipps entered the Austrian discount market with 7 stores. Primark currently operates with 5 large-scale locations throughout Austria, while TK Maxx manages 18 stores to date.

A significant aspect contributing to the rise of the discount market is the increasing disparity in purchasing power among population groups. Despite the overall rise in average purchasing power, the low-income population segment is also expanding, which represents a crucial target demographic for these companies. Furthermore, the broad and affordable product range offered by discounters attracts customers with so-called “ungoogleable products,” which stimulate impulse purchases.

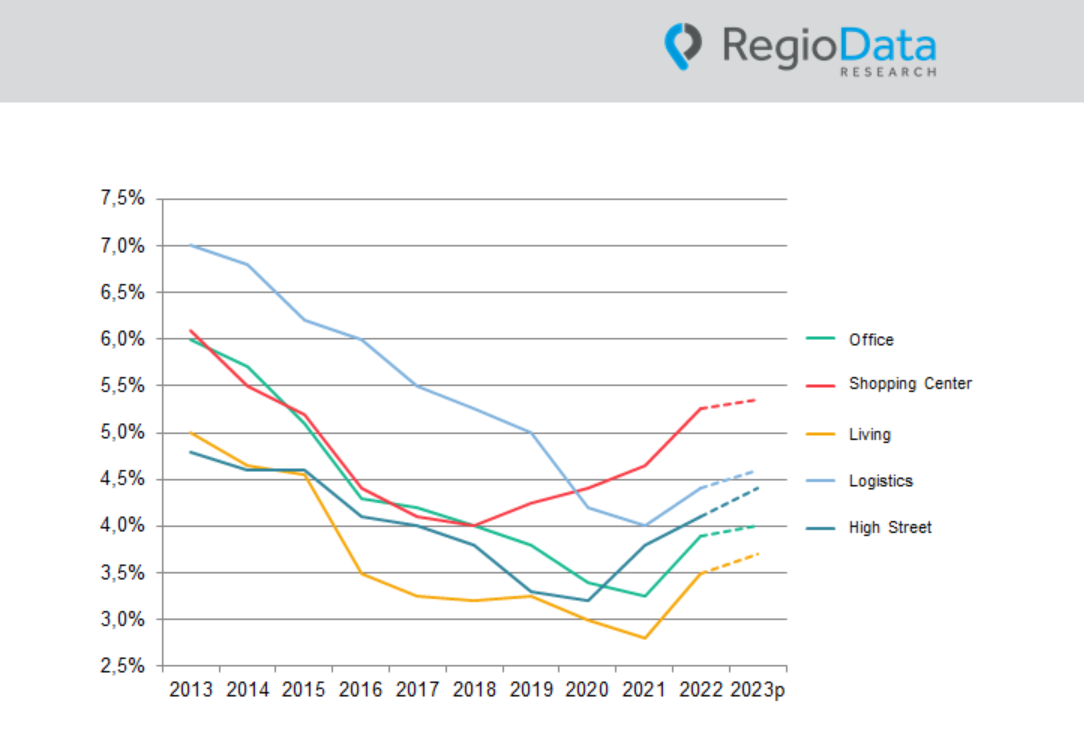

Another development that has emerged in the wake of the COVID-19 pandemic for promotional goods is the decline in rental prices for retail spaces, especially in shopping centers. This creates favorable expansion opportunities, including at prime locations, for discounters.

The combination of very affordable prices, a wide product selection, and now also very good locations continues to signal a promising course for the discount market in Austria, which can only be halted by two trends: changing consumer behavior (e.g., anti-fast fashion, environmental concerns, consumer restraint, etc.) and the rapidly gaining importance of Chinese discount portals on the internet in Austria (e.g., Temu, Shein).

Share post