austria

Turning Point in Grocery Retail – Store Density Has Been Declining for 4 Years

Since 2022, the industry has been continuously reducing its market locations – in 2024 alone, more than 50 grocery stores had to close. At the same time, revenues continue to rise, driven by higher prices. Efficiency gains, targeted expansion into rural areas, and the optimization of existing stores now shape the strategy – a trend that is likely to sustainably transform the grocery trade.

Over 50 Fewer Locations in Just One Year

After years of continuous growth, Austria’s grocery retail sector is experiencing a clear turning point in store numbers. While the total number of grocery stores increased slightly but steadily until 2021, a downward trend has been evident since then. In the past year alone, more than 50 locations were permanently closed.

Closures are no longer limited to small independent stores—large retail chains are now increasingly affected as well. With some delay compared to other retail segments, grocery retail is also pursuing a strategy of reducing sales floor space. However, the scale of reduction remains moderate so far: in the past two years, total sales area has decreased by just 0.3%.

Revenue Growth Despite Fewer Locations

In 2024, Austria’s grocery retail sector recorded nominal sales growth of 4.5%, reaching a total of €29.2 billion (gross). This increase was driven primarily by rising prices, partly as a result of continued high inflation.

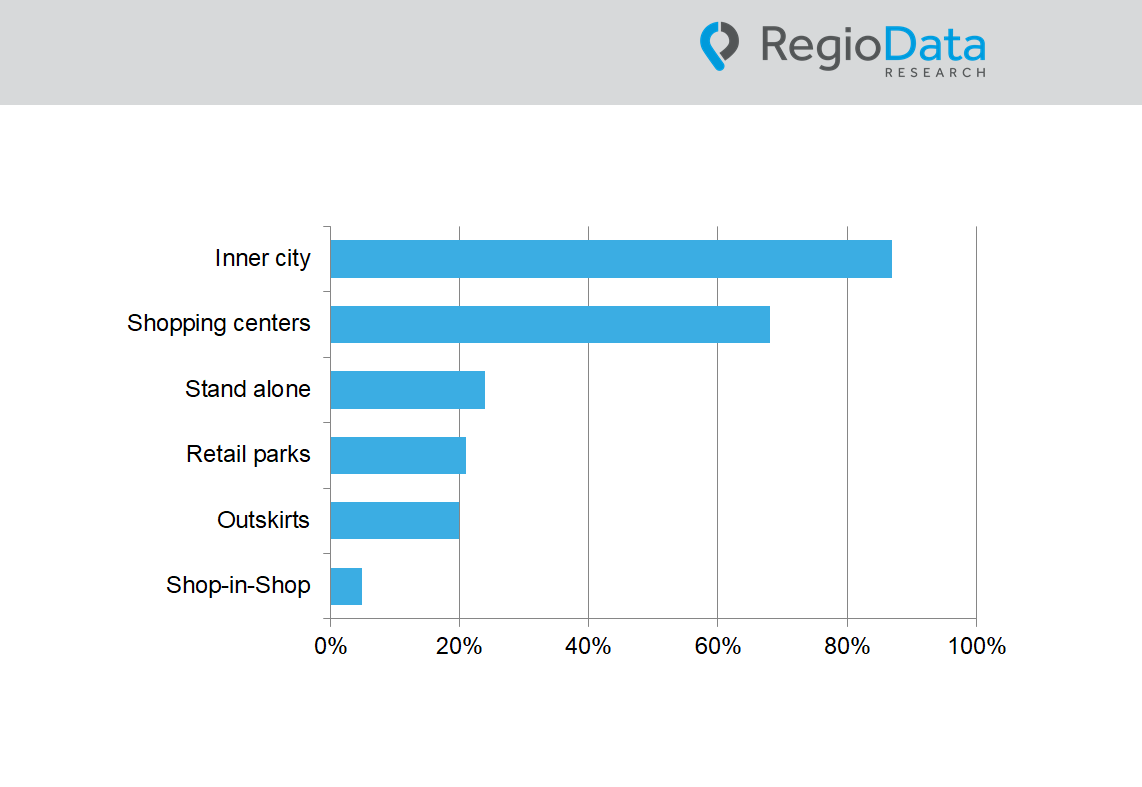

Despite higher revenues, grocery retailers are increasingly focusing on reducing floor space. Efficiency improvements, concentration on high-traffic locations, and the optimization of existing stores are moving to the forefront of strategic planning.

Dominance of the “Big 4” Remains Unbroken

The “Big 4” – Spar, REWE Group, Hofer, and Lidl – continue to hold a dominant position in Austria’s grocery retail sector. Together, they account for 75% of all store locations and 92% of total sales. Spar and REWE alone command a combined market share of 67%. Discount retailers maintain a stable share of around 29% compared to the previous year.

While the number of store locations has slightly declined for both Spar and REWE Group since 2021, Lidl’s presence has remained steady. Hofer, in contrast, has been expanding, opening ten new locations since 2021.

REWE Expands in Rural Regions

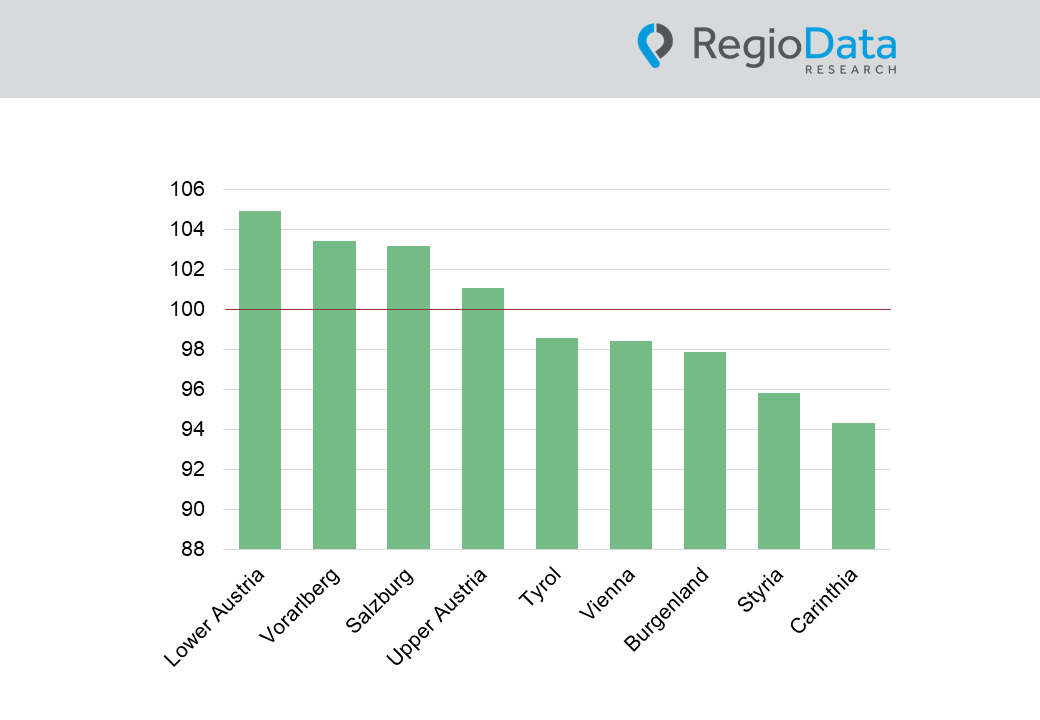

Regionally, Spar Group and REWE Austria share market leadership across the country. One notable exception is local hero M-Preis, which continues to dominate the Tyrolean Oberland. Traditionally strong in western Austria, Spar has recently managed to gain modest market share in REWE’s core territory of Vienna and its surroundings. At the same time, REWE Group has been steadily strengthening its foothold in rural regions of Styria and Carinthia.

Conclusion

Austria’s grocery retail sector remains highly concentrated. Shrinking margins are forcing retailers to optimize operations—closing, relocating, or modernizing stores. Location optimization, targeted expansion into rural regions, and efficiency improvements are increasingly shaping corporate strategies. This trend is set to define the future of grocery retail in the years ahead.

Share post