austria

AUSTRIA: Retail sector – market concentration reaches record high

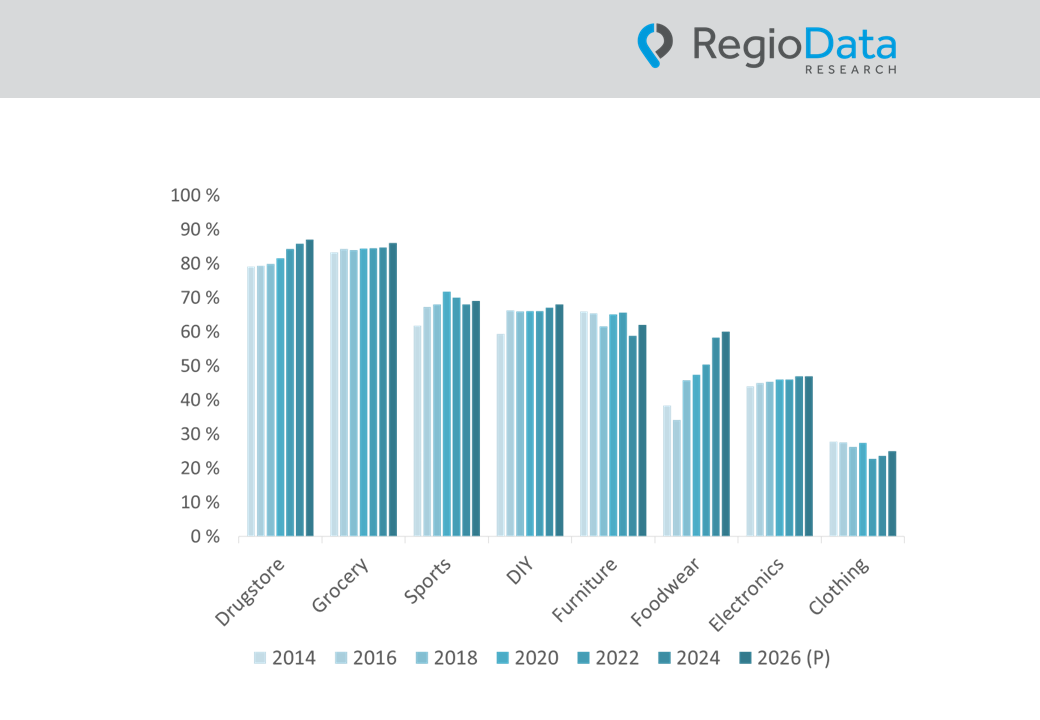

The Austrian retail sector is increasingly dominated by a few large companies. In particular, the largest providers in the grocery and drugstore segments continue to consolidate higher and higher market shares. Compared to other European countries, Austria thus exhibits an above-average level of market concentration—a trend that is also reflected in other retail sectors. RegioData Research expects these concentration tendencies to continue in the coming years.

Few Companies Shape Retail: Market Power Solidifies Over a Decade

The Austrian retail sector is characterized by high and steadily increasing market concentration in the key industries. A recent long-term analysis by RegioData Research shows that from 2014 to 2024, market shares in many retail segments have increasingly concentrated in the hands of a few large companies. Over the past ten years, the market leadership has remained remarkably stable.

This development is particularly pronounced in the drugstore sector and increasingly in the footwear segment. In the grocery trade, a clear long-term consolidation of market structures is evident. Three retail groups control the majority of the Austrian grocery market—a concentration level that ranks well above the European average. Current analyses by RegioData Research show that the Spar Group and REWE Austria dominate the market, together accounting for around two-thirds of total grocery retail turnover.

Very High Concentration as a Structural Feature of Retail

Even at the start of the observation period, a significant share of market volume in several retail sectors was concentrated among a small number of leading companies. Over the past ten years, this concentration has intensified. Market share gains mainly occur within the leading corporate groups, while smaller providers and new market entrants achieve only limited shares.

In the grocery sector, the top three companies already held 83.3% of the market in 2014. By 2024, this figure had risen further to 87.4%, demonstrating remarkable stability at the top of the Austrian grocery retail market over the decade.

Drugstore Sector: Strong Concentration Among Few Providers

Market concentration is particularly pronounced in the Austrian drugstore sector. From 2014 to 2024, very few companies have accounted for the vast majority of market volume. The market structure is characterized by exceptionally stable leadership positions, while alternative formats or smaller market participants have hardly gained significance.

During this period, the market share of the top three companies increased from 79.1% in 2014 to around 85.8% in 2024. The main driver of this development is dm Drogeriemarkt, which expanded its market share from 29% to over 36%. Together with BIPA, these two providers already account for more than two-thirds of the total drugstore market. The expansion of Müller further strengthens concentration, with nearly 90% of consumer spending in the drugstore sector now going to dm, BIPA, and Müller.

Long-term comparisons show that market shares in the drugstore sector not only remain high but that concentration has further solidified over time. Competition primarily occurs among the leading companies.

Three Corporations Dominate Grocery Retail: High Concentration at a Sustained Level

Concentration in grocery retail has also been high for years. In 2014, the largest companies already controlled a major share of the market, and by 2024, this share had increased further. The top three companies—Spar, Rewe, and Hofer—now account for nearly 90% of the market, with a slight upward trend, driven largely by the strong performance of the Spar Group. Austria’s grocery retail market is thus one of the most concentrated in Europe: Spar and REWE Austria alone already control around two-thirds of the total market.

Other Sectors – Varying Dynamics

Besides grocery and drugstore retail, other sectors also show significant structural changes. In the sporting goods sector, Intersport and Sport 2000 have dominated for years, while the third-largest market participant has changed multiple times. Currently, Hervis holds third place, while the former market leader Sports Direct (formerly Intersport Eybl) is no longer relevant.

In the DIY sector, market leadership has also shifted: after Baumax exited the market, Obi emerged as the clear leader, although overall concentration trends remain moderate. In furniture retail, turbulence following the closure of the Kika/Leiner group led to a market reorganization, benefiting primarily XXXLutz and IKEA. No further concentration surges are currently evident.

The footwear sector is particularly volatile, marked by numerous market exits. The top three companies have changed multiple times, with the Deichmann Group currently dominating, followed by Leder & Schuh AG. In electronics retail, there is a slight increase in market concentration, with MediaMarkt maintaining a clear lead.

Clothing retail remains the least concentrated sector. Despite many different concepts, the top three providers—H&M, Peek & Cloppenburg, and the Inditex Group—have gained market share since the COVID-19 shock.

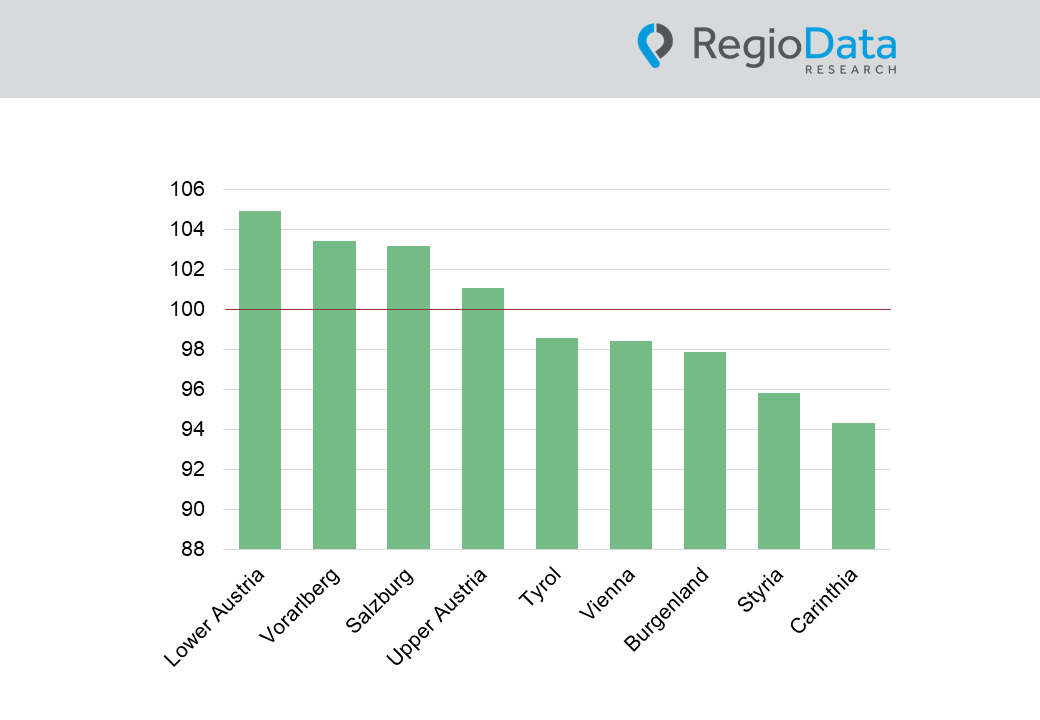

Austria’s Position in a European Comparison

In a European context, Austria ranks among the more concentrated markets. International comparison data show that while market shares in many European countries are distributed across several large providers, the top companies in Austria hold an above-average share of the total market. Retail in Austria has already reached a very high level of concentration, which is remarkable even by international standards.

This is especially true in the drugstore sector, where concentration is significantly above the European average and therefore unique. In Germany, Italy, and France, market shares are spread across several large retail groups, resulting in less concentrated markets. A similar concentration level to Austria is seen mainly in Switzerland, where Migros and Coop—just two providers—control around 80% of the grocery market. Smaller markets tend to have higher shares for leading retailers, favored by smaller market sizes, high branch density of fewer chains, and long-established market leaders.

Outlook: No Change in Trend Expected

For the coming years, a fundamental dissolution of existing market structures is not expected. Long-term developments suggest that store networks and strong brands will continue to secure the market position of large retail companies. The market power of a few companies is set to increase further.

In grocery retail, REWE and Spar have expressed interest in acquiring many Unimarkt locations, suggesting that concentration is likely to continue rising in 2026 and beyond. The market has been highly concentrated for years, and this trend is expected to persist in the foreseeable future.

Share post