austria

Online retail 2025: Growth with new dynamics

The annual RegioData analysis is the only comprehensive evaluation of online retail in Austria that is not based on surveys, but on companies’ online sales. Over 1,000 online shops are systematically analyzed each year – a well-founded overview of the structure, development and trends in Austrian online retail.

Online Retail Gaining Strong Momentum Again

Online retail in Austria is once again on its familiar growth path. After a phase of euphoria during the COVID-19 pandemic followed by a period of consolidation, the sector has seen significant sales increases over the past two years. Austrian consumers are currently spending around €11.6 billion online annually—equivalent to approximately €1,270 per person. Clothing, footwear, and electronics are especially in demand.

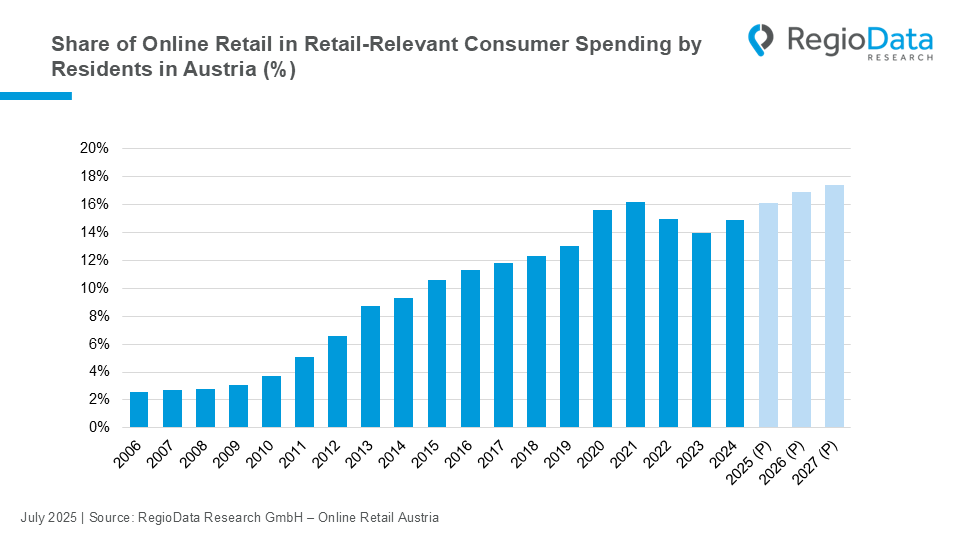

Online purchases now account for 15.5% of consumer spending relevant to retail, approaching the pandemic peak of 16%. Just a year ago, this figure stood at 14%. This continues the upward trend in e-commerce that has persisted for 15 years—and by 2026, a new record high could be reached.

Austria Above EU Average, but Behing Neighboring Countries

In international comparison, Austria’s online retail share of around 15% places it slightly above the EU average, but still behind Germany and Switzerland, each at 17.3%.

The European leader remains the United Kingdom, with a share of around 28%, while China (42%) and South Korea (32%) lead the global market. At the other end of the spectrum is the Balkan region, where online shares are sometimes as low as 7%.

A clear northwest-southeast divide shapes the European e-commerce landscape. In addition to purchasing power, the density of brick-and-mortar retail space plays a key role in online market development: countries like the UK—with high purchasing power and relatively low availability of physical stores—tend to reach particularly high online shares.

Shop-Apotheke and Shein on the Rise – New Top 10 in Austrian Online Retail

Amazon (excluding Marketplace) will remain firmly at the top in 2025. Behind it, the Otto Group, Zalando, and IKEA continue to hold their positions in the top 4. However, beyond that, the rankings are shifting noticeably, with some clear movers and new entrants.

Shop-Apotheke climbs from 6th to 5th place thanks to a significant increase in sales, pushing MS E-Commerce GmbH (Mediamarkt) down a spot. XXXLutz also improves, moving up from 8th to 7th place. New to the top 10 is Infinite Styles Services Co LTD, the company behind Shein, which enters the leading group for the first time.

Apple holds steady in 9th place, while H&M drops from 7th to 10th. The REWE Group falls out of the top 10 to 11th place. Momentum is also building among the next tier: SPAR now ranks 12th, followed by Best Secret in 13th.

Marketplaces—including Amazon Marketplace, Temu, and eBay—are gaining importance overall, now accounting for 42% of total online retail sales, with Temu showing especially strong growth and the trend continuing to rise.

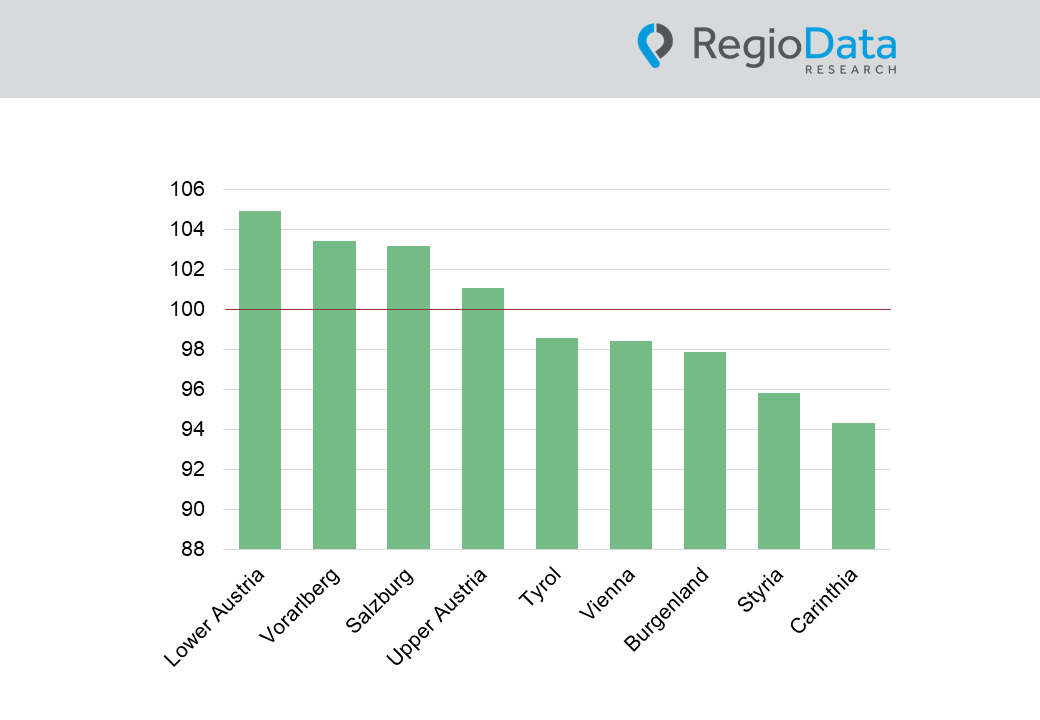

Salzburg Rises to the Top in Online Affinity – Burgenland Remains at the Bottom

Currently, the city of Salzburg has the highest online affinity in Austria, closely followed by several districts in Vienna and Linz. With an index value of 105.2 each, Salzburg and Vienna’s 1st district share the top spot, followed by Vienna’s 7th district (104.5), Linz (104.4), and Vienna’s 8th district (104.1). Notably, Salzburg jumped from 15th place to the top within a single year. Linz also displaced Graz from the top 5 this year.

At the lower end of the scale are districts from Burgenland once again: Güssing, Oberpullendorf, Jennersdorf, Rust, and Oberwart show the lowest online affinity, with index values between 91.7 and 93.

Industry Overview: Fashion Sector Shows Strong Growth – Online Retail Expands Across All Segments

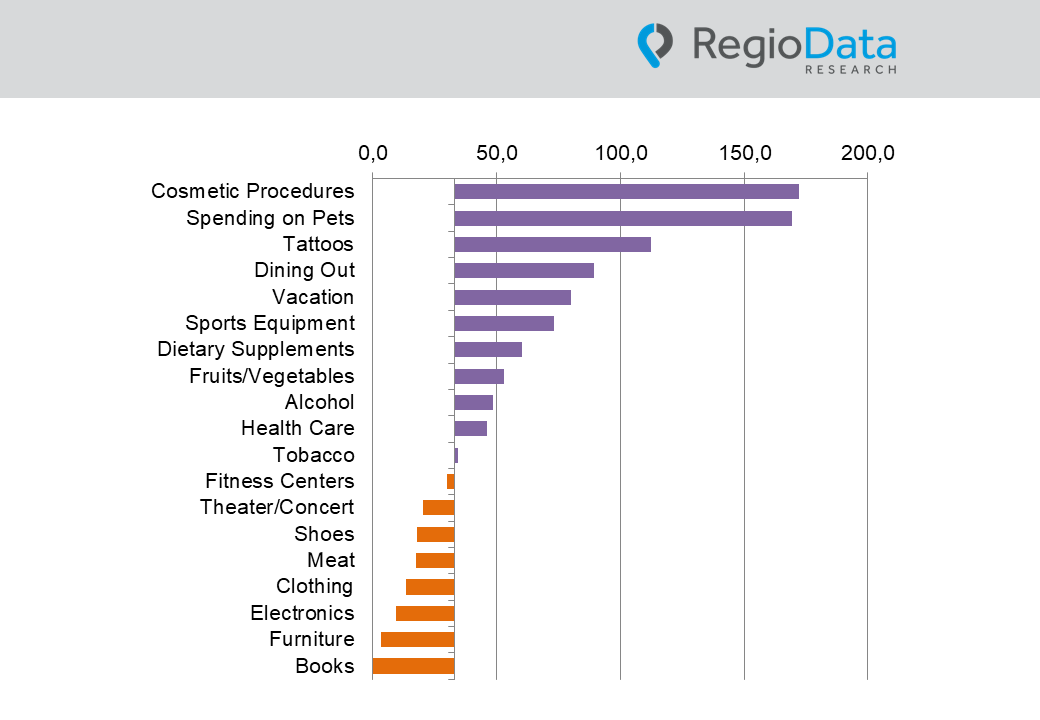

Austrian online retail is growing across all industries—none of the twelve product categories examined experienced a decline in their online share.

At the top, as in previous years, is the electronics/computer category with an online share of 43%, closely followed by shoes (35%) and clothing (33%). The fashion sector again showed particularly strong growth: compared to the previous year, the online share for shoes increased by 5%, and for clothing by 4%.

An upward trend is also visible in traditionally less online-oriented sectors: DIY products rose from 11% to 14%, furniture from 16% to 18%, and drugstore items—including pet supplies—reached a 16% share, a 2% increase.

The only exception remains the grocery sector: with an online share of 2.3%, it continues to rank last among the industries—despite some localized growth in delivery services.

Conclusion

Online retail in Austria continues to grow—across nearly all industries and often with significant increases. However, the market is becoming more concentrated: larger players are getting bigger, while smaller shops are increasingly disappearing. Strong brands and platforms are expanding their market shares, whereas many smaller providers struggle under rising competitive pressure and the high demands related to visibility, logistics, and pricing.

Share post