austria

Consumer Spending 2025: Dining and Health Instead of Retail

Austrian purchasing power is rising – but the retail sector feels little of it. Instead of spending on traditional consumer goods, the surplus is increasingly flowing into dining, health, and savings accounts. Shopping areas such as fashion, electronics, or furniture continue to lose significance. Overall, retail now captures only around 30% of purchasing power.

Purchasing Power Rises – Retail Sector Loses Out

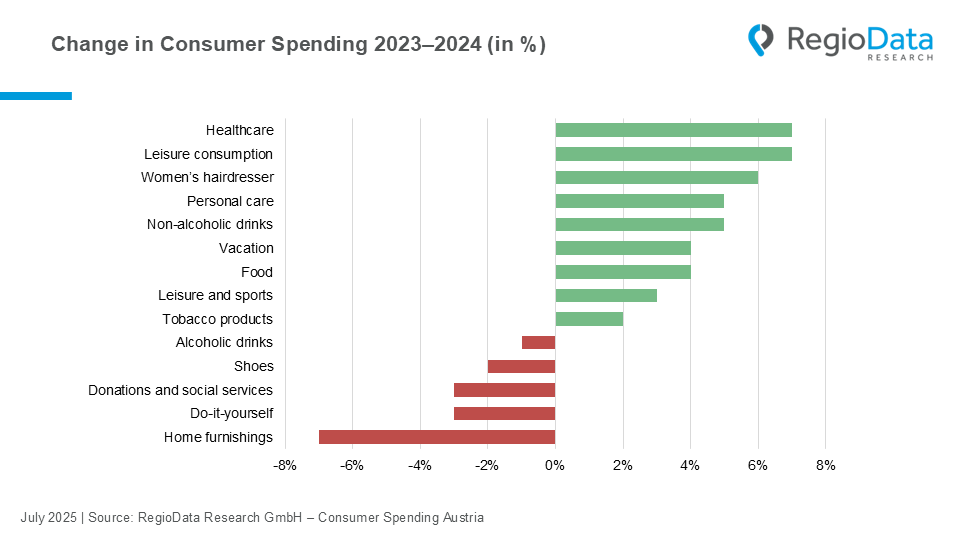

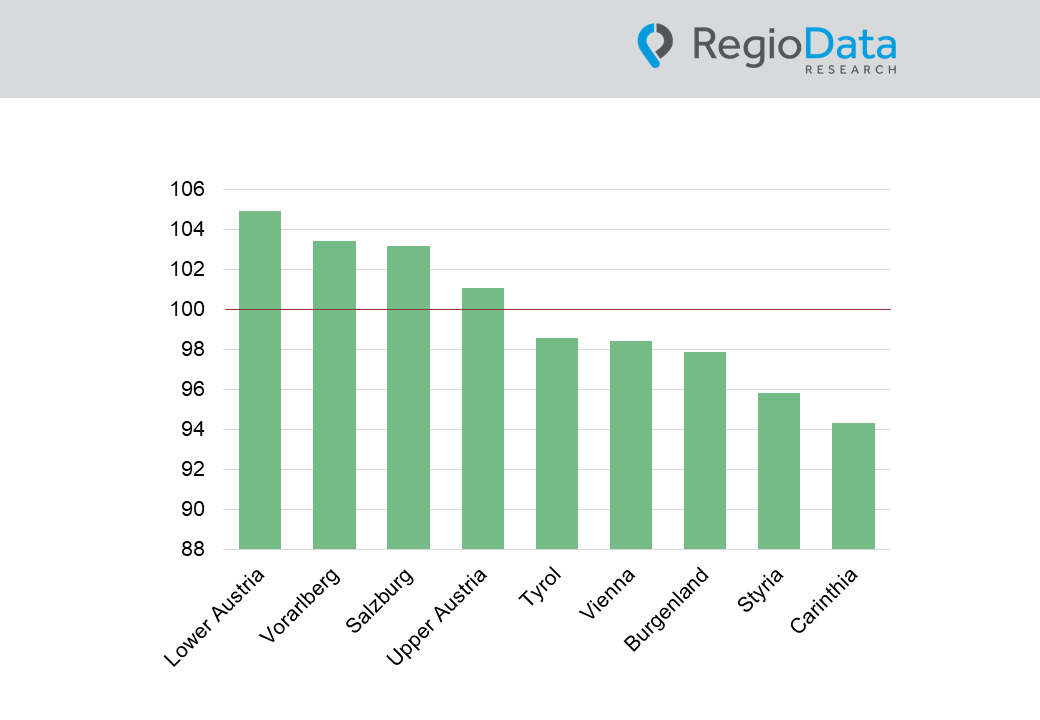

In 2024, the average Austrian has more money at their disposal than ever before – around €28,400 – a nominal increase of 5% compared to the previous year. Even in real terms, adjusted for inflation, purchasing power is once again growing. However, this financial gain is accompanied by a shift in consumer behavior: spending is increasingly moving away from traditional retail. The share of spending on non-food retail – such as clothing, furniture, or shoes – has dropped significantly over the past ten years: from 16.0% in 2014 to just 12.6% in 2024. The trend is clear: despite rising purchasing power, consumer goods continue to lose significance.

Saving Instead of Donating: Saving Behavior at Corona Levels

A growing portion of disposable income is now going toward private financial security. The share of savings within consumer spending has nearly doubled since 2014 and, at just under 12%, has once again reached the high levels seen during the COVID era. On average, each person saves nearly €3,300 per year, with €2,370 of that going into private savings accounts. Life insurance policies are also seeing similar growth. At the same time, spending on donations and social contributions has declined by 3%.

Spending on Dining Out Continues to Rise – One in Three Euros for Food Goes to Restaurants

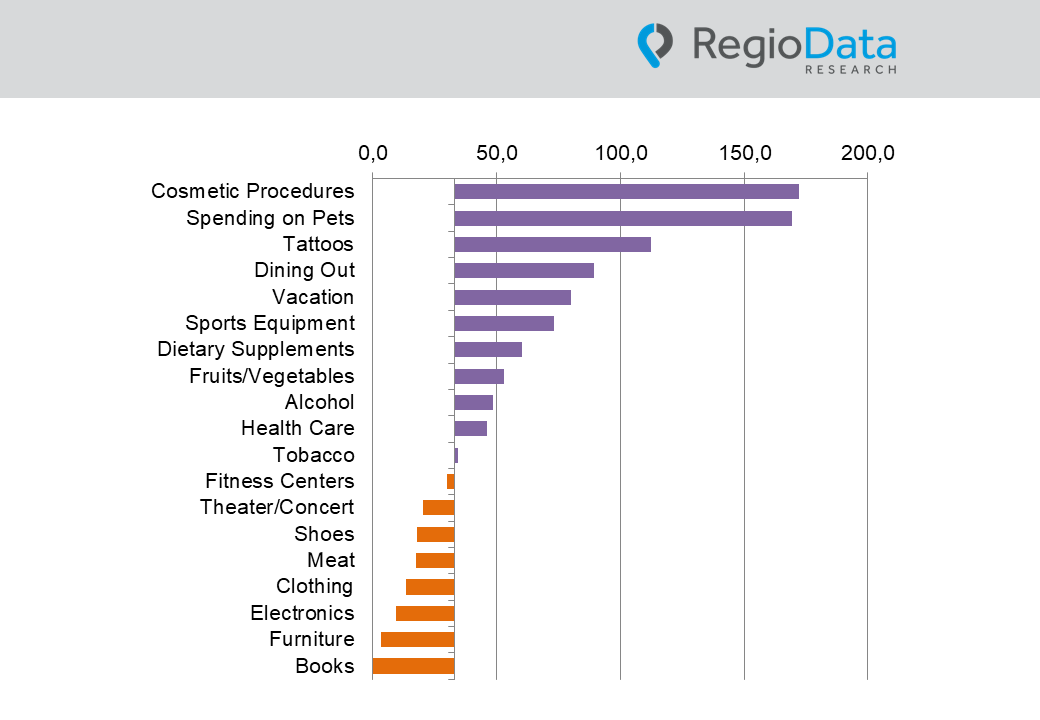

Austrians’ appetite for dining out continues to grow: they now spend nearly €2,000 per year on food outside the home – a significant increase from around €1,600 two years ago. Currently, 38% of total food expenditures are already going toward out-of-home consumption.

The leisure-oriented gastronomy sector is developing particularly dynamically: per capita spending in this area is €1,620 – an increase of over €100 compared to the previous year. For comparison: in 2014, the figure was just €970.

Delivery services and catering are also gaining importance: average spending in this category recently rose by 6% and now stands at nearly €100 per person.

More Money for Healthcare, Less for Alcohol

The trend toward greater health awareness is also reflected in consumption patterns: spending on alcoholic beverages has decreased by 1% compared to the previous year, while spending on non-alcoholic alternatives has increased by 5%.

The desire for well-being and self-care now extends across many areas of life. Spending on personal care (+5%), women’s hairdressing (+6%), and – to a lesser extent – cosmetic treatments has risen. The healthcare sector also shows clear growth: costs for dental visits have increased by 11%, private health insurance by 8%, and health-related products such as dietary supplements by 10%.

The education and recreation sectors are also experiencing a strong upswing: of the total €3,200 spent per person, €1,244 goes toward leisure and sports, €1,026 toward vacation travel, and around €330 toward culture and entertainment – such as cinema, theater, or museums. Alongside a slight increase in gambling expenditures (+4%), interest in traditional media is also rebounding: book purchases now average €61 per person per year.

Decline in Home Furnishings

In 2024, spending on furnishings and household goods has declined for the first time: on average, Austrians are spending €1,762 in this category, which includes furniture, cleaning services, electrical appliances, dishes, and other household items. Within this, spending on home furnishings specifically has dropped by 7%. The do-it-yourself (DIY) trend is also losing some momentum, with a decline of 3%.

There are, however, increases in everyday household management: spending on cleaning services and related goods and services has risen by 7%.

Conclusion

Current consumer data clearly shows: Austrians are becoming more conscious and deliberate in their spending. Instead of impulsive shopping, the focus is now on security, quality of life, and enjoyment – in the form of saving, health, and dining out.

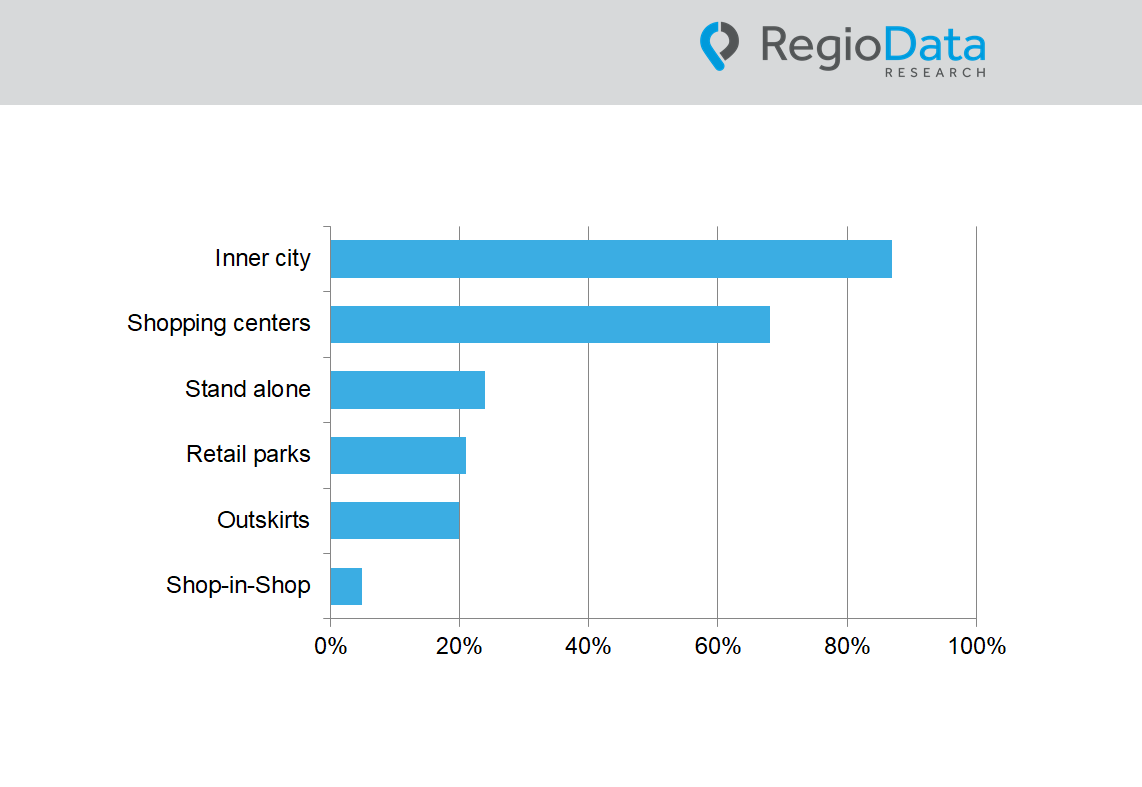

For brick-and-mortar retail, this is a clear signal: purchasing power alone is no longer enough – consumer priorities have permanently shifted.

Share post