poland

Shopping centers - Saturated market

Just a few years ago, the pipeline for retail construction projects in Poland was full to bursting, with up to 20 new shopping malls with a total of 700,000 m² opened each year.

But those days are over. In 2019, there were only three new malls, two of which were in Warsaw. This is the lowest figure since 1995. Last year’s biggest new opening in terms of area was Galeria Młociny in Warsaw, with a size of 85,000 m². Overall, three shopping malls, one outlet center and two retail parks joined Poland’s new retail zones in 2019. These have a total of 178,000 m² of new retail space. In 2018, however, the figure was just under 345,000 m², down 48% on the previous year. The coming years could slow the downward trend somewhat, as almost 50 small to medium-sized projects are in the pipeline, but the probability of realization of these projects is highly variable. Large shopping center projects are almost entirely missing from the project list.

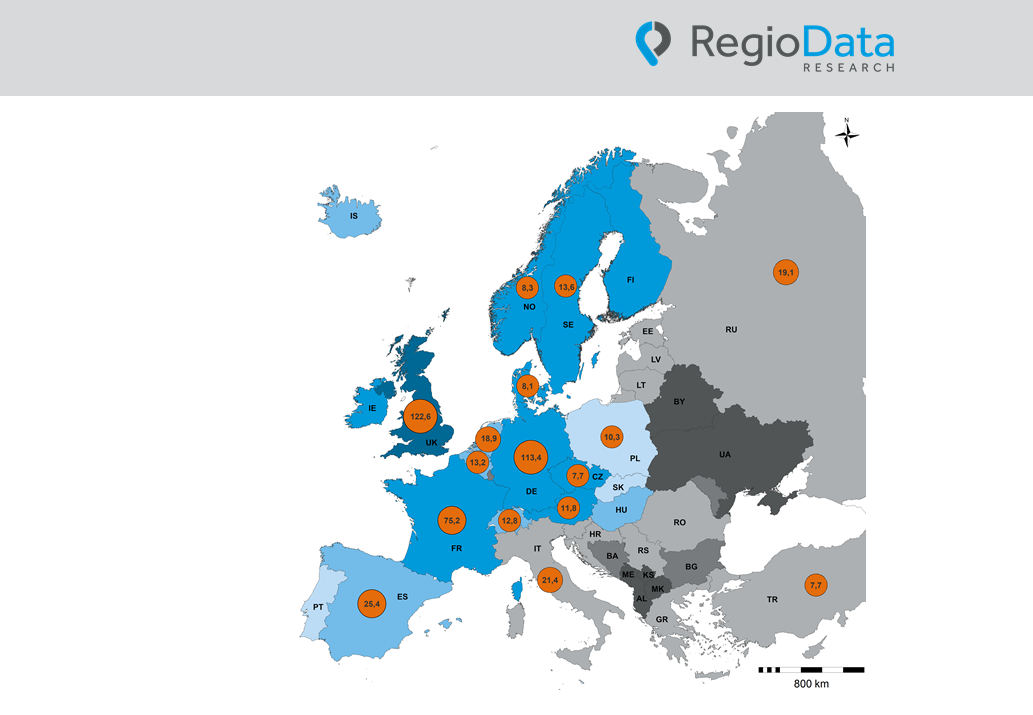

Poland already boasts a number of impressive, larger-than-average and modern shopping centers. The sales area density is 340 m²/1,000 inhabitants, a top value in the CEE countries. The special size structure of the shopping centers compared to other CEE countries is particularly remarkable: As many as 18 centers have a sales area of more than 70,000 m² (comparison: Germany 14 centers), 60 others have a sales area of more than 40,000 m². Most of these large centers opened between 2000 and 2010, especially in Warsaw and the secondary cities. In contrast, with a few exceptions, current plans envisage centers in the range of 20,000 to 40,000 m², and these projects are often located in cities with even fewer than 100,000 inhabitants.

Share post