News

ÖSTERREICH: Handelsstandorte – Deutlicher Rückgang und nur sehr kleine Lichtblicke

Die sich wandelnde Handelslandschaft spiegelt sich auch in den Expansions-plänen der filialisierten Einzelhändler, Gastronomen und handelsnahen Dienstleister wider, wie die aktuelle Analyse …

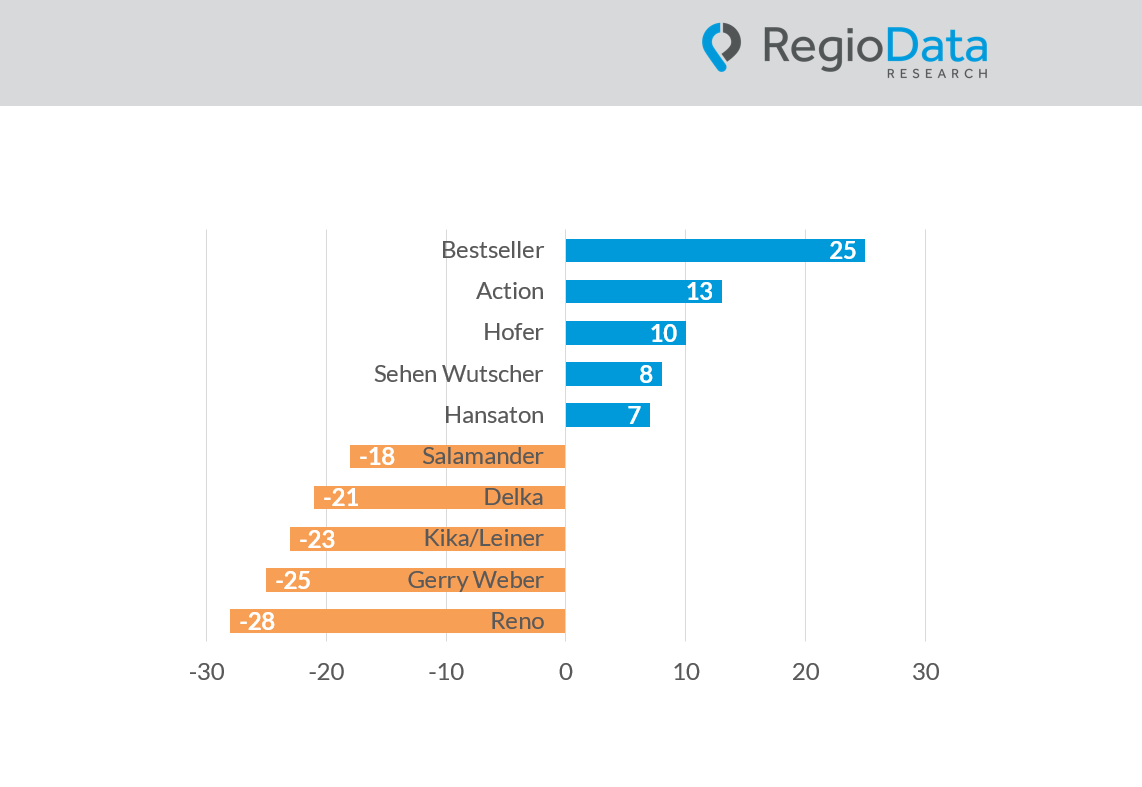

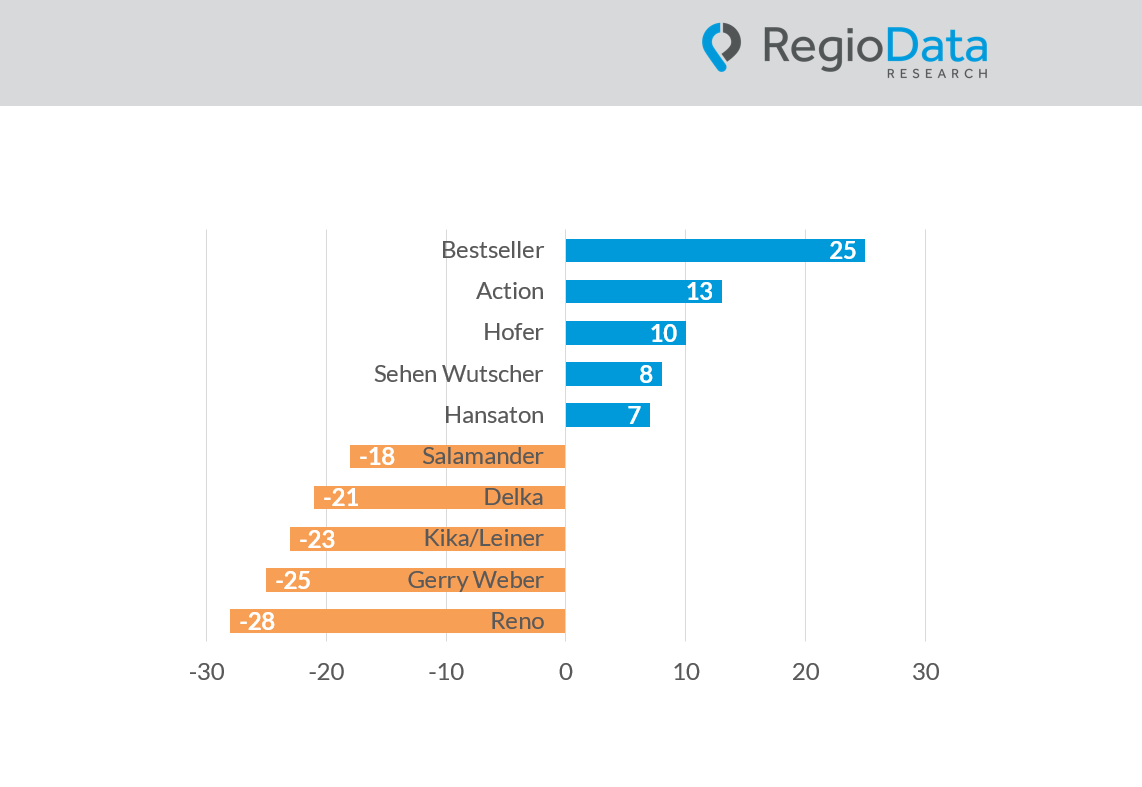

ÖSTERREICH: Schuhhandel unter Druck – Zwischen Giganten und Gebeutelten

Der österreichische Schuhhandel hat in den letzten Jahren einen dramatischen Wandel durchgemacht, wie die brandaktuelle Auswertung der RegioData Standortdaten nun zeigt.

ÖSTERREICH: Der Höhenflug der Non-Food-Diskonter

Die Expansion der Non-Food-Diskonter in Österreich ist beeindruckend! Die aktuelle Auswertung von RegioData Research zum Diskontmarkt in Österreich zeigt, wie sich die Filialisten …

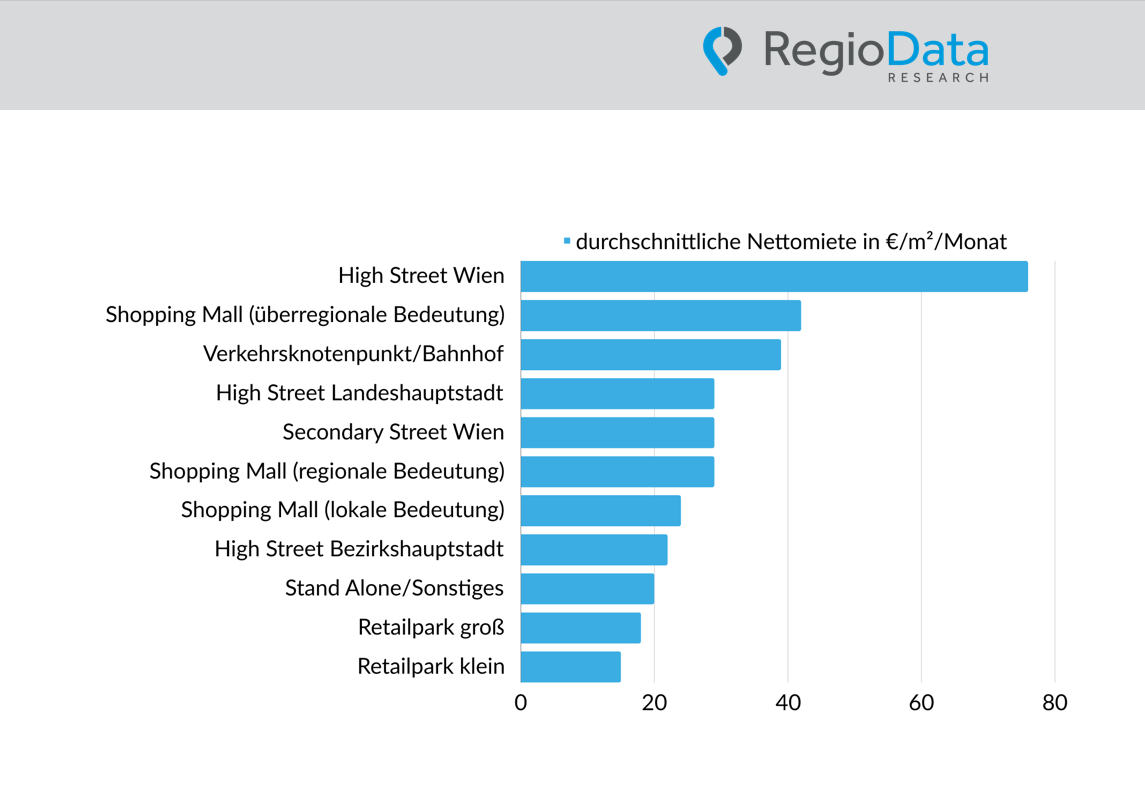

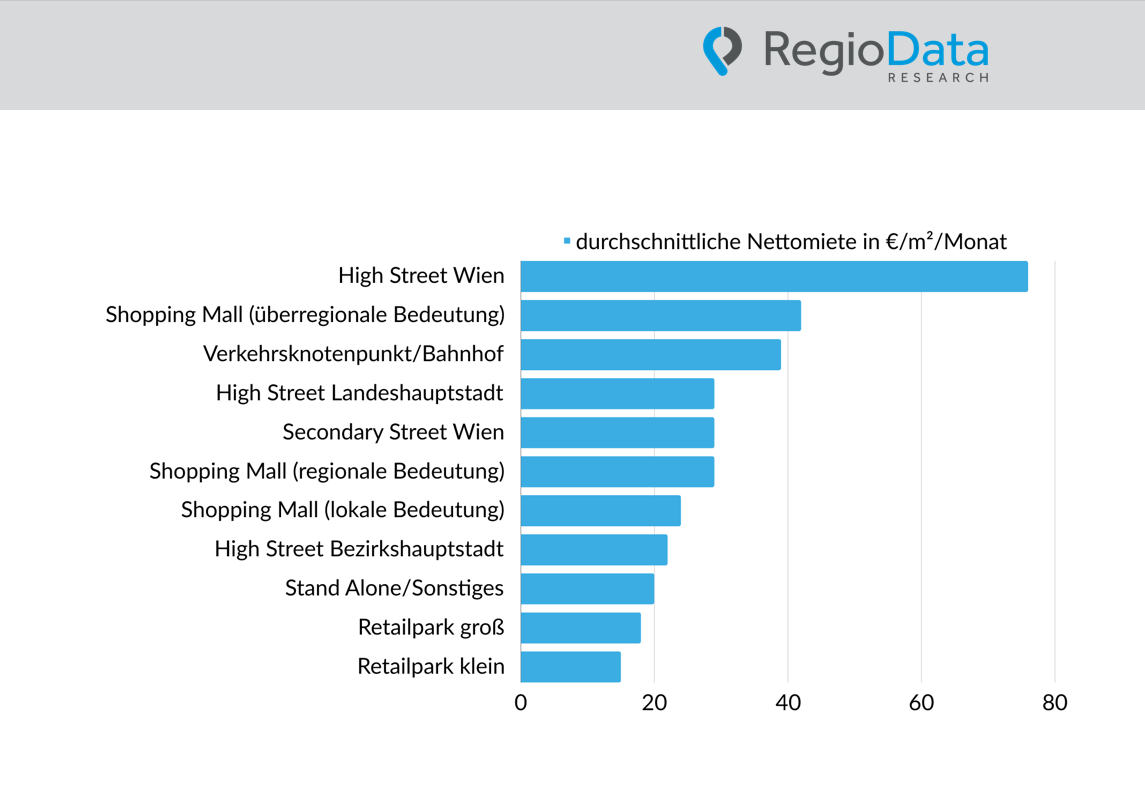

ÖSTERREICH: Retailmieten steigen deutlich langsamer als Inflation

RegioData Research untersucht jährlich etwa 1.500 bestehende Mietverträge von Unternehmen im Handels- und handelsnahen Sektor. Diese einzigartige, objektive und …

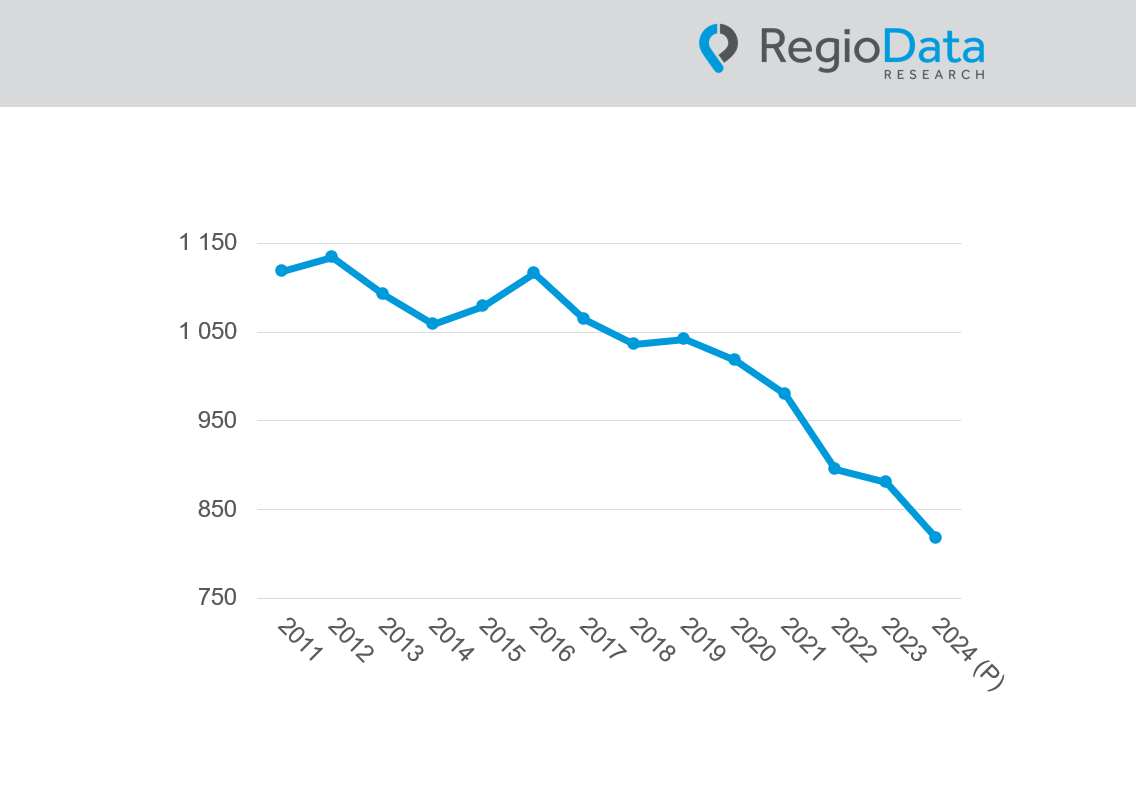

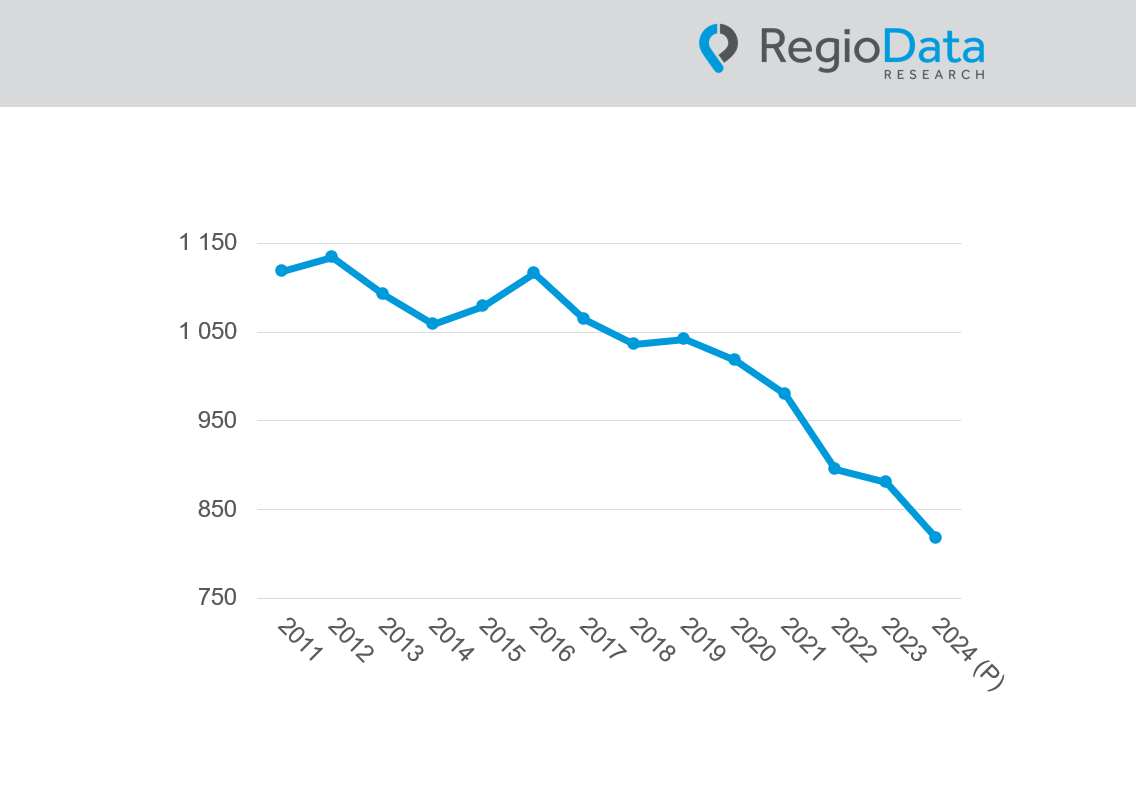

ÖSTERREICH: Handelsstandorte – Deutlicher Rückgang und nur sehr kleine Lichtblicke

Die sich wandelnde Handelslandschaft spiegelt sich auch in den Expansions-plänen der filialisierten Einzelhändler, Gastronomen und handelsnahen Dienstleister wider, wie die aktuelle Analyse …

ÖSTERREICH: Schuhhandel unter Druck – Zwischen Giganten und Gebeutelten

Der österreichische Schuhhandel hat in den letzten Jahren einen dramatischen Wandel durchgemacht, wie die brandaktuelle Auswertung der RegioData Standortdaten nun zeigt.

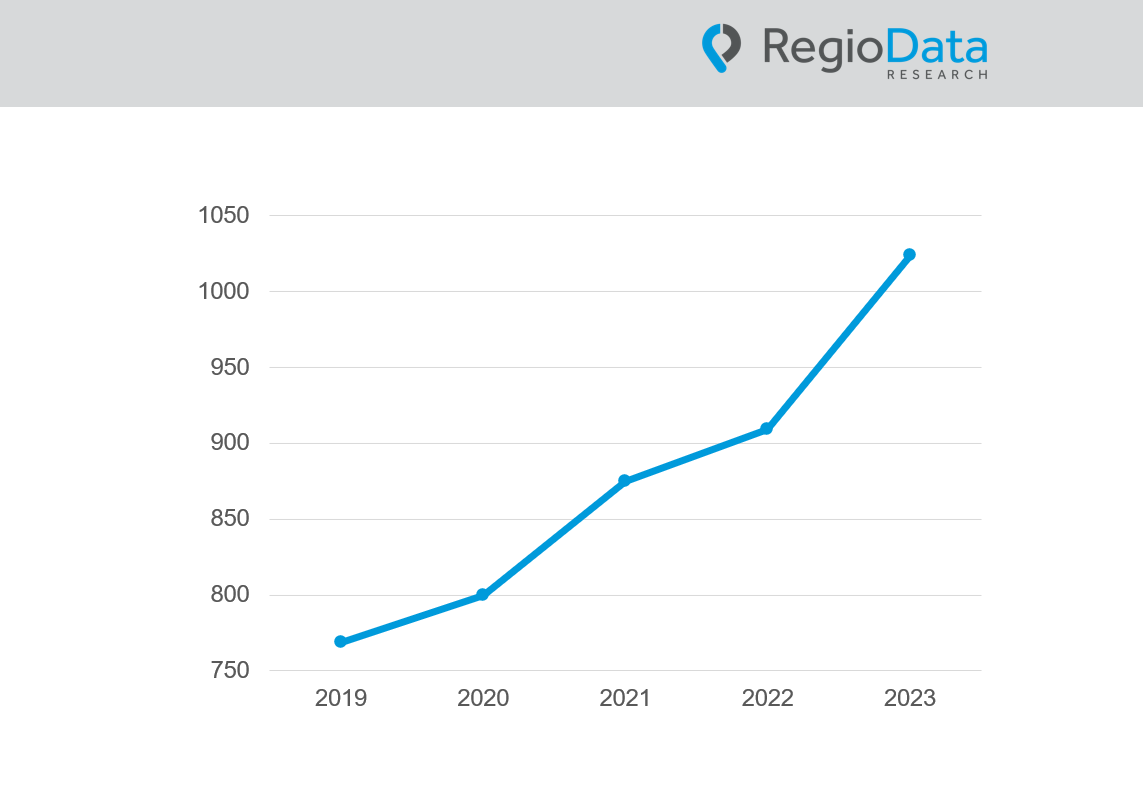

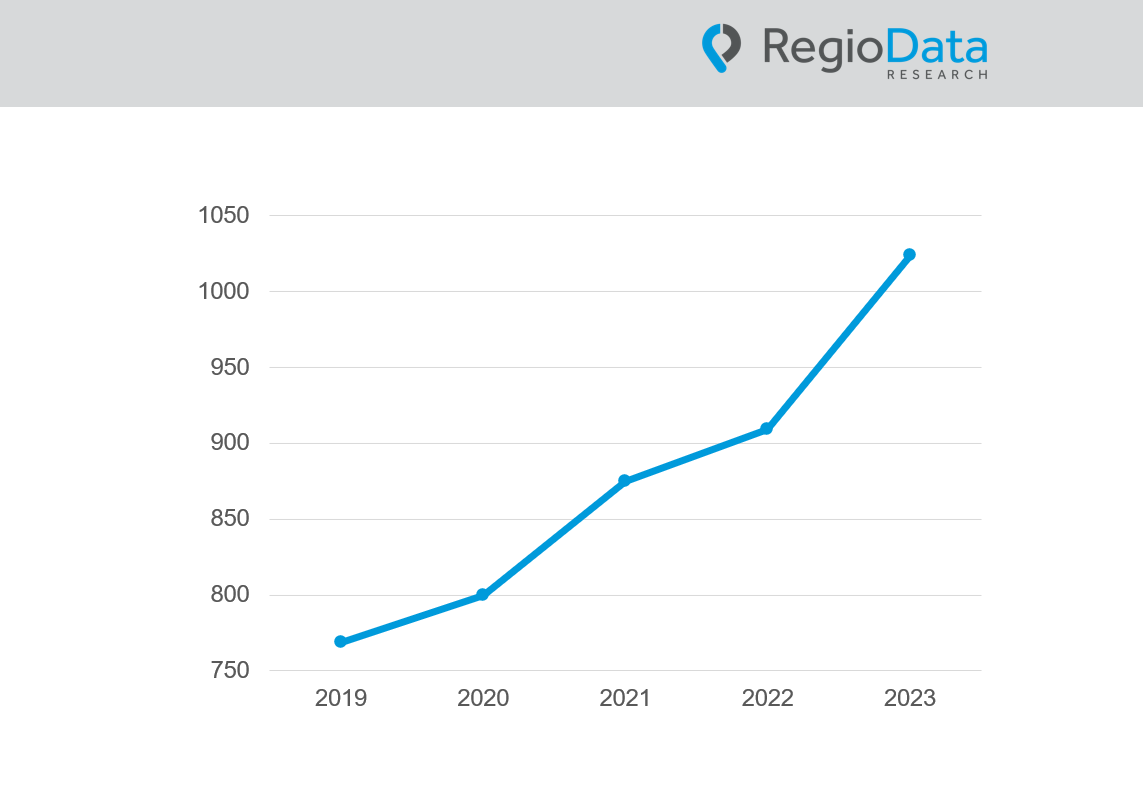

ÖSTERREICH: Der Höhenflug der Non-Food-Diskonter

Die Expansion der Non-Food-Diskonter in Österreich ist beeindruckend! Die aktuelle Auswertung von RegioData Research zum Diskontmarkt in Österreich zeigt, wie sich die Filialisten …

ÖSTERREICH: Retailmieten steigen deutlich langsamer als Inflation

RegioData Research untersucht jährlich etwa 1.500 bestehende Mietverträge von Unternehmen im Handels- und handelsnahen Sektor. Diese einzigartige, objektive und …

Pressekontakt

Amela Salihovic, M.A.

Marketing & PR